Superpowered pensions: Essential strategies to get the retirement you deserve

Farmers and other self-employed people: With tax reliefs on pensions, a comfortable retirement will cost you far less than you might think.

, a pensions expert with FDC, explains why a pension is simply the most tax-efficient savings account in the country

Before delving into pension contributions and their many benefits, it is important to firstly look at what a pension is and how they play such a vital role within financial planning in Ireland.

A pension is simply the most tax-efficient savings account in the country. Revenue allows for money paid into the pension to qualify for tax relief at your marginal rate, essentially giving a discount of 20% on every €1 paid for a standard rate taxpayer, and a 40% discount on every €1 paid for a higher rate taxpayer.

Assets held within the pension grow tax-free, with no Exit Tax, CGT or DIRT deducted. The tax-free compounding of returns is the true superpower of pension investing.

Once the pension holder reaches the drawdown stage, typically between the ages of 60 and 75, a tax-efficient lump sum of 25% of the pot can be taken as cash, with remainder of the pot typically staying invested and paying an income during retirement, making a pension a hugely tax-advantaged savings account.

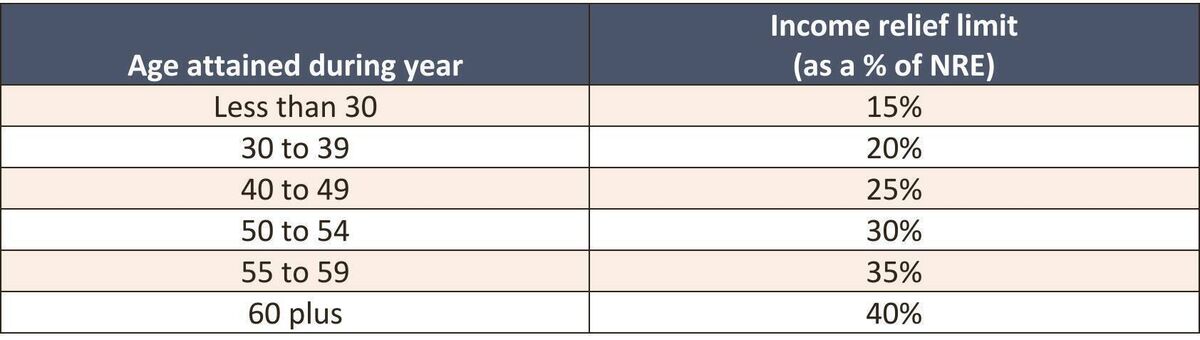

The amount that an individual can contribute in a year is dictated by their net relevant earnings (NRE) for income tax purposes as illustrated in the following table:

For this article, the focus will be on the farming community looking at farmers in a self-employed setup. However, the points made translate to those working in other industries and those in employment wishing to make extra contributions.

With tax filing deadline approaching, 14 November 2024 for online filing, a steady flow of self-employed farming clients are attending for their annual financial planning reviews having already with met their accountants to go through the income tax return.

Together, the level of pension contribution is agreed to make as a Single Contribution to reduce income tax for the 2023 tax year; typically looking to reduce the level of income at the higher rate as much as possible using the NRE limits detailed earlier in the article.

When possible, pension savers should also look to use a monthly regular contribution to automate their savings. This regular monthly contribution will be paid on the same date every month irrespective of what is happening in financial markets, or the global economy, allowing the contributor to benefit from euro-cost averaging to smooth out the ups and downs of the market. Single contributions can also be added before tax deadline to reduce tax further where needed.

Let’s look at a worked example of a 21-year-old farmer with farm wages of €30,000 per year. While the higher rate of tax will not be an issue here, the tax benefits of pension investing, and power of compounding make a very compelling case to get a regular contribution started, even if at €100 per month. The following assumptions have been made for this example:

- Monthly contribution of €100.

- 540 monthly contributions to be made.

- 20% tax relief attained on each contribution.

- Contributions invest in a diversified Global Equity fund focused on the developed world.

- Assumed rate of return of 7% per annum (this is not guaranteed, and values can fall as well as rise).

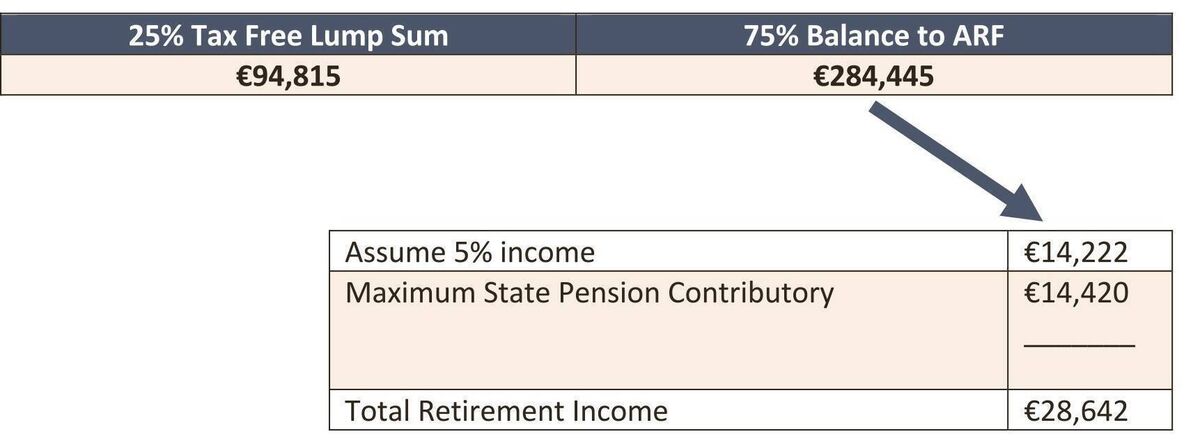

- Drawdown at State Pension Age of 66 using a 25% tax-free lump with the balance invested in an Approved Retirement Fund (ARF).

The assumed pension pot at 66 years of age could be €379,260, which is accessed as follows:

The total contributed over this farmer’s 45-year working life was €54,000. When the 20% tax relief is applied the actual cost of the contributions is €43,200. Thanks to the effects of compounding investment returns over a long period of time, a very significant pension can grow from a modest monthly contribution. This shows that every person working in the country should have a contributory pension.

Many of our farming community continue to contribute right up to their mid-70s. The 40% discount offered for higher rate taxpayers by way of tax relief is a compelling reason why a pension contribution is an essential option for those looking to reduce the tax they each pay, while also setting aside resources for a period of time where they will no longer be working.

The best time to start building your contributory pension is the minute you enter the working world. The second-best time to start is today.

If you’re interested in learning more about careers at FDC Group, please email or visit our stand at the Ploughing Championships (Block 1, Row 9, Stand 117).

- Adrian White is a Certified Financial Planner™ Professional working as a Financial Consultant and Pensions Technical Manager within the FDC Group in the Southwest Region.

- FDC Financial Services Ltd is regulated by the Central Bank of Ireland.