What is lifestyle financial planning?

While our savings goals and our income may change throughout our lives, smart financial planning is key at all ages.

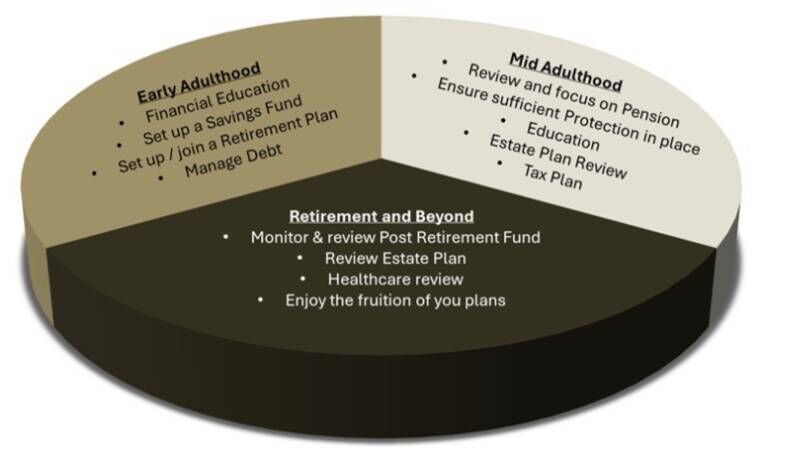

Lifestyle financial planning is setting out a road map of issues to be addressed as we age.

Having worked in the financial services area for in excess of 30 years (where did they go?), the following piece sets out what I have encountered and that of my colleagues.

Operating a progressive pension and investment consultancy, lifestyle financial planning goes beyond traditional financial strategies, which typically focus solely on monetary aspects, but incorporates deeper and broader lifestyle considerations including career, family, health, and personal. Firstly, seek advice. Ideally from a capable and impartial advisory firm. Do your homework and meet with a few. This process will provide far greater insight than you would imagine.

The following sets out our approach to individuals with whom we interact and why it resonates with so many of our clients.

Let's break it down by life stage:

Many of us, at this age, are not financially educated. We exist from pay packet to pay packet, despite our elders best advices. Start by learning the basics of personal finance, including budgeting, saving, and investing. Start the conversation with an independent advisor, you wont regret it.

If buying a home is a goal, start saving for a deposit and consider the costs of homeownership. Act, financially, as if you are in this position to ready yourself for mortgage application and all that comes with owning your own home.

Enroll in an employer-sponsored retirement plan (where available or instigate your own Pension through an appropriate Private Retirement Savings Account (PRSA) ) and contribute enough to take full advantage of any employer matching contributions and tax reliefs available

Pay off high-interest debt like credit cards while keeping loans and other lower-interest debt in check. Use a debit card as opposed to a credit card, you will be thankful that you did.

Consider basic insurance coverage like health insurance, life & disability insurance to protect against unexpected events. Your income is your greatest asset, protect it!

Ramp up contributions to retirement accounts as income grows, aiming to save 10-15% of income or more. Remember the government provides attractive tax reliefs against such contributions reducing the cost to you. It’s a no brainer.

Have your advisor deliver your estimated cash flow chart outlining your overall income expectation, during retirement. Do not underestimate the value in increasing your pension contributions, even if the increase is modest. The compounding effect of this is significant.

Plan for the financial responsibilities of starting a family, including childcare costs, education savings, and life insurance. Where applicable, review benefits covering such issues under your Occupational Pension Scheme. It’s cheaper.

The number of individuals who don’t maximise death benefits, in particular under such arrangements, reflects poorly on the advice being received. We all focus on the estimated pension at retirement. The problem with this sole approach is that the assumption is made that we reach retirement age. What if we don’t?

Invest in professional development and skill-building to increase earning potential and career opportunities.

It’s probably the number one issue that we encounter in this age bracket. We have no Will and need to address. Yes we do! The problems associated for those who don’t have a Will are none. For those dependants, left behind, dealing with such matters at a time when we are least capable, it’s a different scenario. In addition, review your Inheritance & Gift Tax position both as a beneficiary and disponer. This is a silent tax that is, and will become more, prevalent for all of us.

Ensure you are completing actions in the most tax efficient manner, for you, incorporating tax deductible costs where applicable. Seek advice from a tax advisor, where appropriate.

Assess retirement savings and projected income to determine if adjustments are needed to meet retirement goals. Think ahead! Take account of all previous pensions from previous employments and consider the strength of your overall pot.

Aim to pay off remaining debt, including mortgages and other loans, to enter retirement with fewer financial obligations.

Review your healthcare options in retirement, plan for potential long-term care needs.

If planning to retire early, consider the financial implications of early retirement, including healthcare costs and longevity risk. Again, if not already planned for have your advisor deliver your estimated cash flow during retirement

Firstly, congratulations! You made it. Hopefully, you will enjoy a long and healthy retirement. Having managed your affairs in a structured and planned manner, your attention to such matters has paid off. But we’re not finished yet.

Develop a sustainable and tailored withdrawal strategy for retirement savings, considering factors like longevity, inflation, and market volatility. Again, deal with an independent advisor with a track record on this matter. The need to constantly review and evaluate same is of the utmost importance. Some of the larger institutions are simply not geared for this service requirement. Ideally, build a personal relationship with a competent advisory practice.

Continuously monitor healthcare needs and expenses, including long-term care options.

Regularly review and update estate planning documents, including wills, trusts, and exemptions, to ensure they reflect current wishes and circumstances.

Be prepared to make adjustments to spending and lifestyle as needed to align with retirement income and financial resources.

So there you have it. We all have aspirations in life. But how many of us actually achieve our goals? Often we spend a lot of time thinking or talking about what we want. But we don’t take steps to achieve it. It’s not because we’re lazy. It’s because we don’t know where to start. We don't have a plan. By addressing some or all of the aforementioned we can build a solid foundation for the journey.

Learn more at www.insightprivateclients.ie