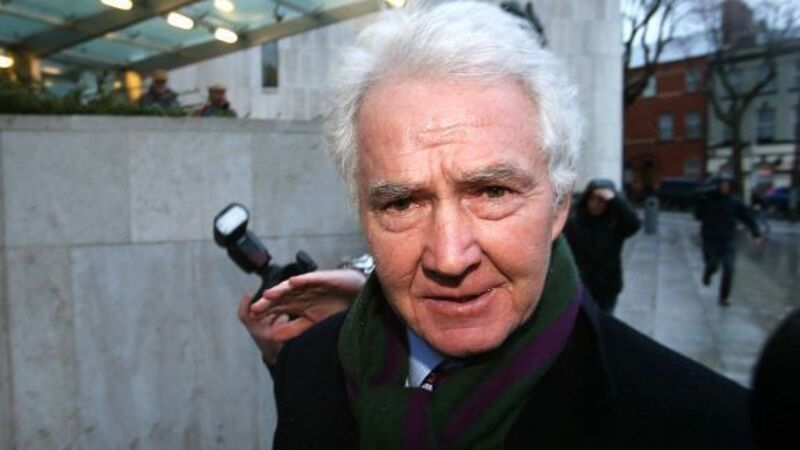

FitzPatrick - the determined banker who wanted to sit at the top table

Dilger explained he was trying to build a sustainable, long-term business model. The shareholders were having none of it. They wanted him out.

Seán FitzPatrick’s presence as a member of the board of directors acted as a lightning rod for the disaffection sweeping the room. Very unflattering comparisons were made between Dilger and FitzPatrick. The latter was the posterboy for the Celtic Tiger.