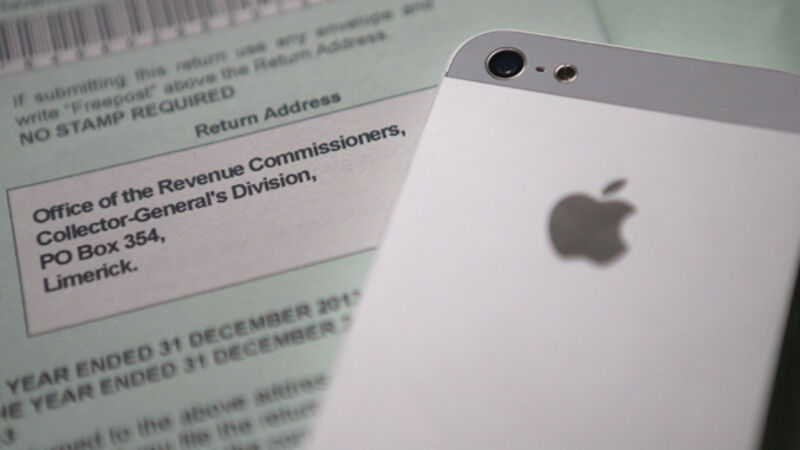

Apple tax ruling: Sheer size of the case is attracting notice worldwide

The EU Commission’s investigation was launched in 2014 under the suspicion that Irish authorities were purposefully miscalculating and underestimating Apple’s taxable profit on products like iPhones and iPads.