Newly elected TDs urge Cork's Eden residents to resist eviction

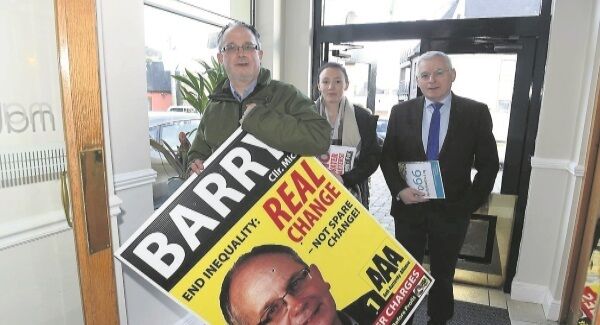

Anti-Austerity Alliance TD Mick Barry and Sinn Féin TD Donnchadh Ó Laoghaire both said they would support any tenants who resisted attempts to force them out of their homes ahead of tomorrow’s deadline for affected tenants to leave the receiver-controlled units in the Eden residential development in Blackrock.

Notices of termination of tenancy have been issued to tenants of 35 of the 127 receiver-controlled units in the development. It is understood 20 units have already been vacated.

Mr Barry last night slammed what he called the “mass evictions” being carried out by receiver Grant Thornton at Eden. The newly elected Cork North Central TD said greed and profiteering was driving people out of their homes.

“I am urging people to stay in their homes and to organise against the kind of mass evictions we are seeing here in Blackrock, Cork, and in Tyrrelstown in Dublin,” he said. “Any tenants who resist evictions of this kind will have the support of the vast majority of ordin-ary people.”

He also said he plans to raise the matter in the Dáil next Tuesday to demand the caretaker Government introduce legislation to prevent evictions of this kind.

Mr Ó Laoghaire also said he would support any resident of Eden seeking to resist their eviction.

“The situation unfolding here is quite clearly the outworking of a housing system dominated by profiteering and greed. The needs of residents and families are not on the radar at all,” he said.

“It is a damning indictment of this state that it is profiteering, rather than the accommodation needs of citizens, that is driving the housing system. This means instability and a lack of security for renters and ballooning profits for landlords, and vulture capital funds.

“Families and individuals make rented properties their homes. That is a reality that should be respected and protected, not subjected to the whims of those looking to line their pockets.”

He has called for emergency legislation to create a compulsory code of conduct for banks and funds, where they are selling buy-to-let properties that are rented.

“The code of conduct needs to give sitting tenants an extended notice-to-quit period of up to 12 months and first option on becoming tenants in the property if it is bought by a new landlord,” he said.