Kieran Coughlan: Mileage opportunity for tax-free payments reduced

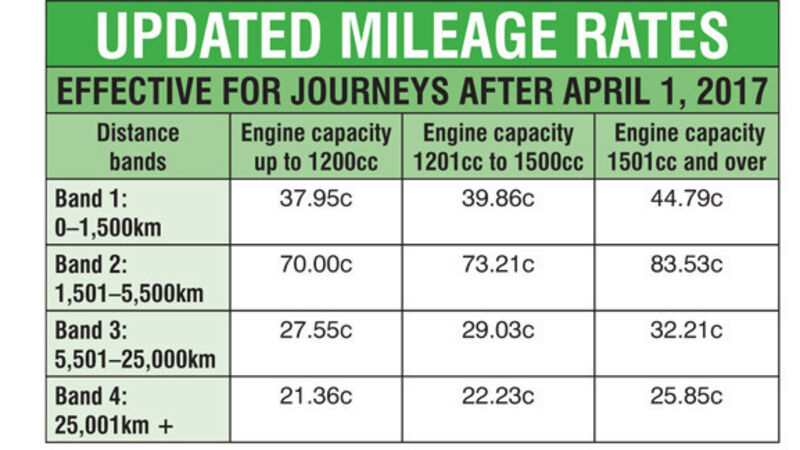

The Department of Public Expenditure and Reform has issued updated mileage rates effective from April 1, 2017.

This is the first change in the mileage rates since 2009.

Try from €1.50 / week

SUBSCRIBEThe Department of Public Expenditure and Reform has issued updated mileage rates effective from April 1, 2017.

This is the first change in the mileage rates since 2009.

Already a subscriber? Sign in

You have reached your article limit.

Annual €130 €80

Best value

Monthly €12€6 / month

Introductory offers for new customers. Annual billed once for first year. Renews at €130. Monthly initial discount (first 3 months) billed monthly, then €12 a month. Ts&Cs apply.

Newsletter

Keep up-to-date with all the latest developments in Farming with our weekly newsletter.

Newsletter

Keep up-to-date with all the latest developments in Farming with our weekly newsletter.

Newsletter

Sign up to the best reads of the week from irishexaminer.com selected just for you.

Newsletter

Keep up with stories of the day with our lunchtime news wrap and important breaking news alerts.

Saturday, February 7, 2026 - 9:00 PM

Saturday, February 7, 2026 - 9:00 PM

Saturday, February 7, 2026 - 12:00 PM

© Examiner Echo Group Limited