Stripe sees 'major uptake' of 10% pay cut offer

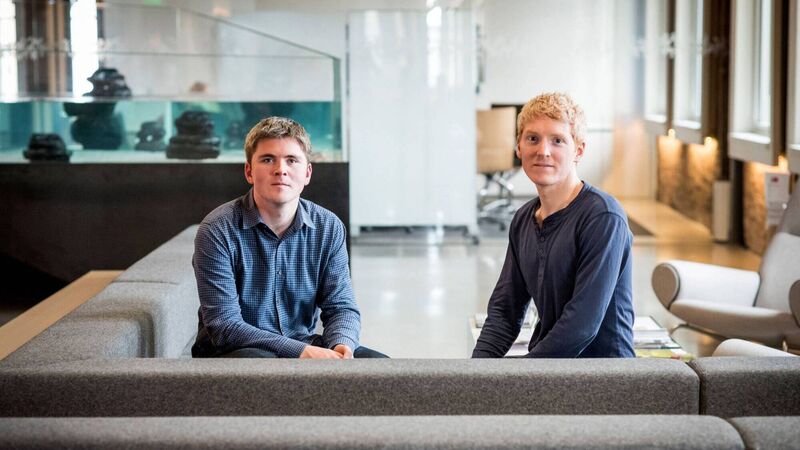

Stripe co-founders John Collison and Patrick Collison. The Irish-founded company has no plans for an IPO.

Irish-founded online payments company Stripe has said it has seen a “major uptake” of the unusual offer it made to staff during the pandemic; namely leave high-cost cities like New York and San Francisco and take a $20,000 (€17,000) bonus to boot.

The catch? Workers had to consent to a 10% cut to their base compensation.