Oliver Mangan: Markets begin to sniff rate hikes in the air

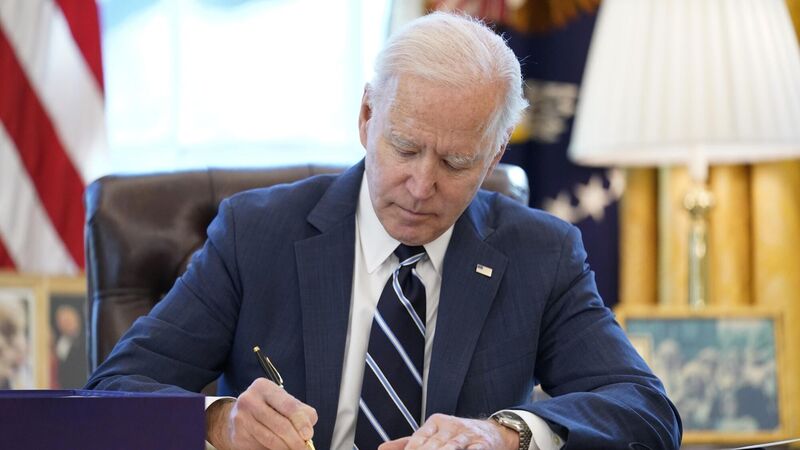

President Biden's fiscal stimulus plan is set to boost the US economy and raise expectations of interest rate hikes.

The main central banks all held monetary policy meetings over the past fortnight.

It saw them try to soothe market fears that rising inflationary pressures could see interest rate hikes commence as early as next year in some major economies.