Capital hotel offering

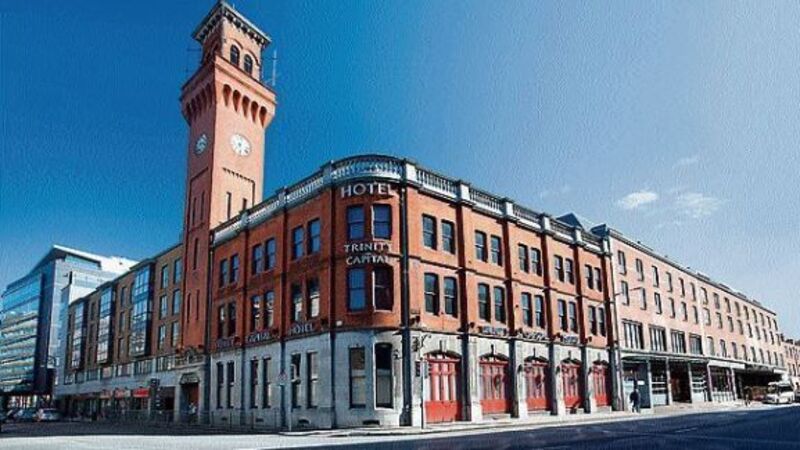

The 195-bed Trinity Capital hotel, which includes the old red-brick Dublin City fire station on Pearse Street, is understood to have made an operating profit of between €2.5m and €3m last year, as the capital’shotels continue to trade — and to sell — strongly.

It comes up for sale via agent Paul Collins of CBRE Hotels, who says Dublin’s hotels have had 30 straight month of positive performance based on the ‘Rev/par’ standard industry measurement, and this is a performance monitored by international and investor buyers who are actively eyeing Dublin hotels.