Budgets usually mean bad news for class of ’08

Born into 1980s Ireland, reared in its roaring Celtic Tiger, and graduating into its cataclysmic aftermath — my generation expected little of our governments and almost nothing of their budgets, writes

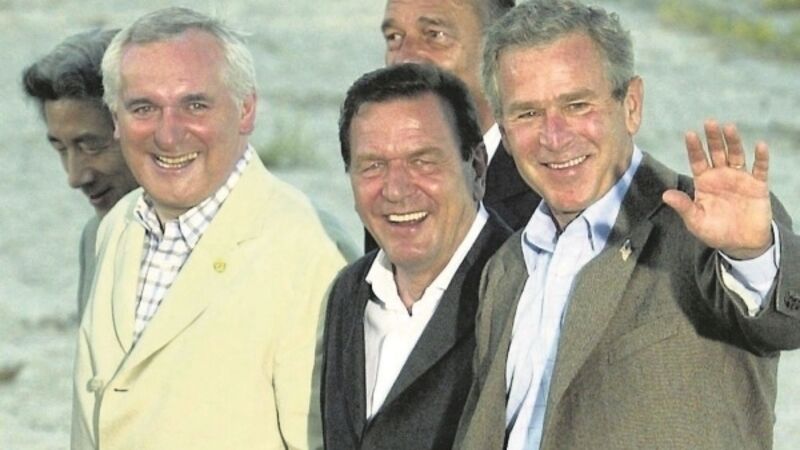

My lasting memory of the Celtic Tiger was Bertie Ahern walking along a beach in his canary-yellow trousers and fawn sports jacket at the G8 summit in 2004. This memory is book-ended by another Bertie memory in April 2008. As I got ready to take my final exams, the taoiseach, this time in a yellow tie, stood on the steps of Government Buildings and called a halt to his three decades in politics.