Fighting inequality - A unified response is required

His area — wealth and income inequality — chimes with the zeitgeist. It speaks to the growing economic and social insecurity felt by millions of people. It recognises that an ever greater proportion of wealth is concentrated in ever fewer hands. It frames the great political challenge of our time — how to sustain something approaching equity and the basic, life-sustaining material security we call the social contract, while encouraging the kind of capitalism that generates the economic growth we all depend on.

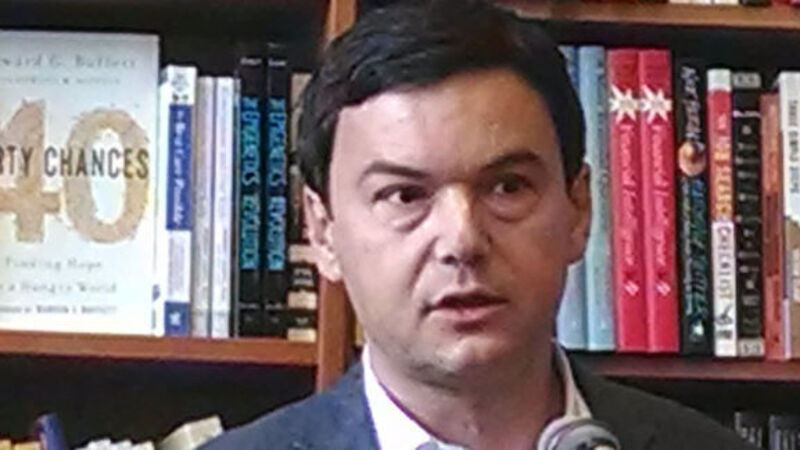

When he speaks in Dublin this weekend he will undoubtedly address this crisis of confidence, this growing, gnawing insecurity spreading through layers of society once absolutely confident that their security and comfort were permanent, immutable realities. Adjusting to the fact that they are not is one of the defining, chastening wake-up calls of our time. The dog-eat-dog employment contracts, the regular threat of pay cuts or closure, the growing rate of perma-temping and long-term unemployment — not to mention the near impossibility of a family life in any way recognisable by earlier generations.