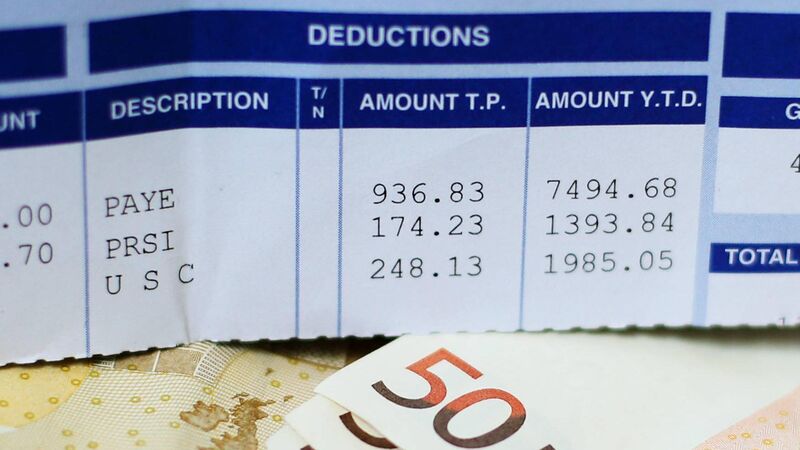

Government considering rise in PRSI rate as part of budget

A Government source noted that increasing the rate of PRSI would not be a popular move. Picture: Brian Lawless/PA Wire

The Government is exploring whether to increase PRSI for workers and employers as early as January 2024, the understands.

Coalition leaders will meet on Wednesday with Finance Minister Michael McGrath and Public Expenditure Minister Paschal Donohoe to hammer out the final details for the budget next week.