Renters facing eviction ahead of new legislation

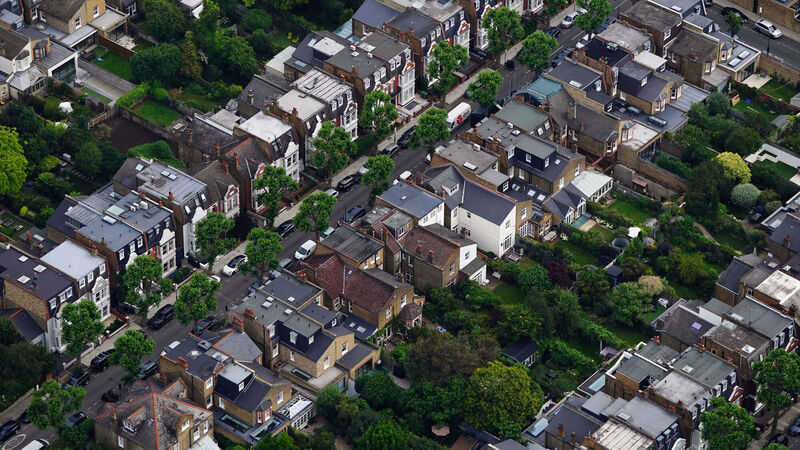

Legislation taking effect from March 1 will give tenants rights to a six-year rolling contract with stronger protections against no-fault evictions. File picture: Victoria Jones/PA Wire

Cork renters claim they are having to leave their homes because investment funds want new tenants to whom they can charge higher rates.

The renters believe the funds want them to leave the properties before new rental rules are introduced in March which aim to improve renters’ security of tenure.