Detached cabin homes in back gardens to be exempt from planning

Planning minister John Cummins is seeking to change these exemptions that would remove the requirement for the extension to be attached to the main property.

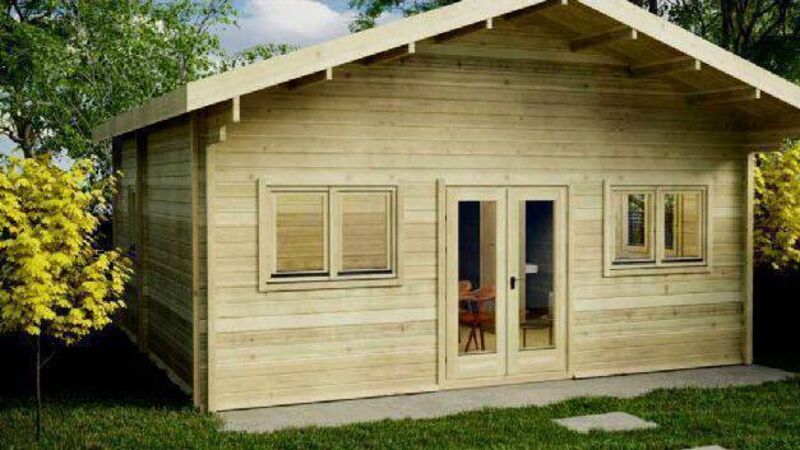

New planning minister John Cummins is pursuing changes to provide exemptions for detached cabin or modular-style structures at the back of properties.

Currently, planning exemptions are in place for a 40sq m extension that is attached to a property.