Bank of Ireland customers warned to repay money or face damaged credit ratings

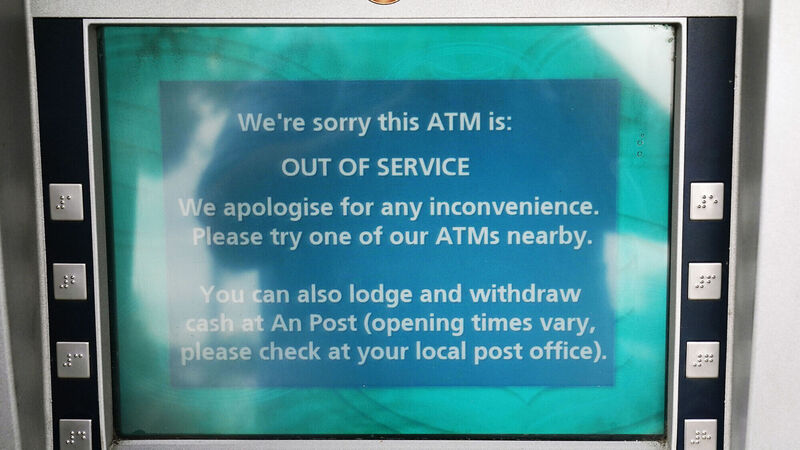

During Monday’s technical blackout, customers found they could withdraw up to €500 that they didn’t have from their Bank of Ireland accounts at ATM machines, or transfer up to €1,000 onto Revolut cards and then withdraw it, sparking scenes of vast queues throughout the night at ATMs around the country. Photo: Brian Lawless/PA

Irish consumer’s rights organisations have urged anyone who withdrew excess money from their bank accounts during Bank of Ireland’s technical failure on Monday night to lodge the money back into their accounts, warning that a large unauthorised overdraft could negatively impact their credit ratings.

During Monday’s technical blackout, customers found they could withdraw up to €500 that they didn’t have from their Bank of Ireland accounts at ATM machines, or transfer up to €1,000 onto Revolut cards and then withdraw it, sparking scenes of vast queues throughout the night at ATMs around the country.