Concern over tax status at Garda College

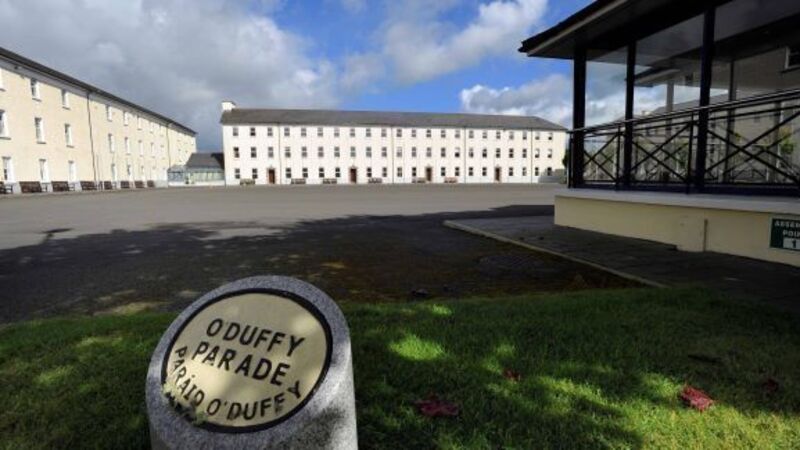

There was widespread confusion at the Public Accounts Committee yesterday as to the status of Templemore’s tax returns to Revenue, with chairman Sean Fleming saying there was the “possibility of a substantial liability”.

And there was also doubt as to whether senior gardaí who are directors of the Sportsfield company on the site have fulfilled their requirements regarding declarations of commercial interests and tax compliance to the Standards in Public Office Commission.