Government TDs to criticise EU order to recoup €13bn in taxes from Apple

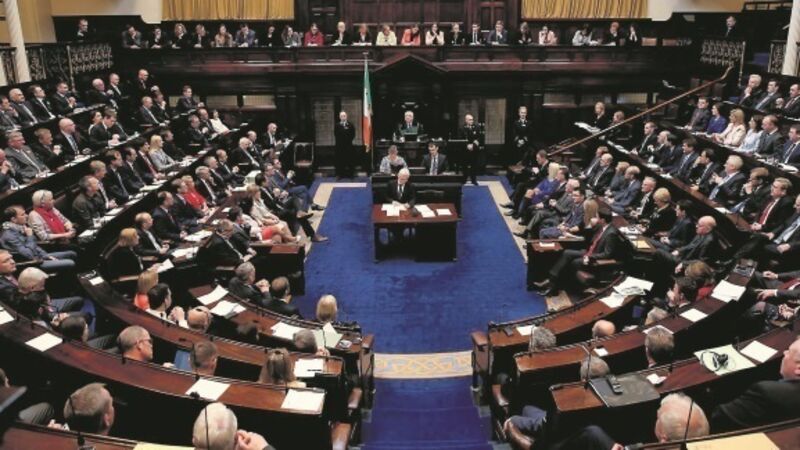

A briefing document circulated to TDs last night ahead of the Dáil debate today on the European Commission judgment also outlines what will be done with the money and Ireland’s position on tax reform.

However, a number of Opposition parties want stronger protections agreed for the Irish tax system before agreeing to the Government proposed motion to appeal the EC ruling.