Rental prices soar as the number of available properties hits record low

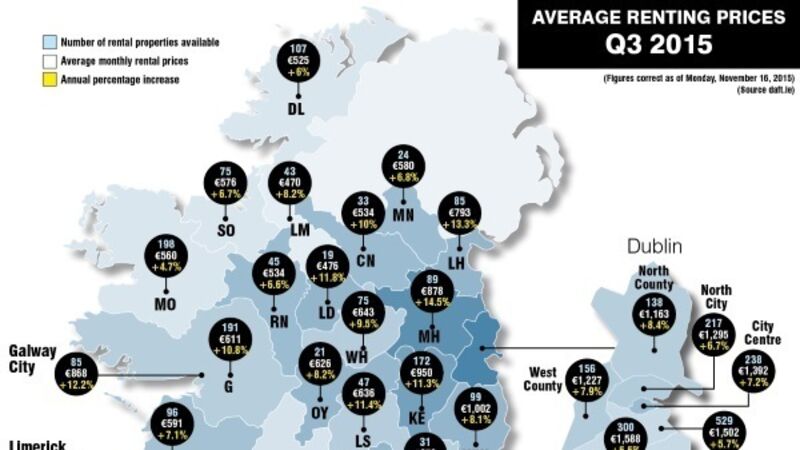

The average cost of renting a house in Ireland now stands at €964 a month, an increase of 9.3% on this time last year.

As of November 1, approximately 4,000 homes were available to rent across the country — the lowest number of rental properties since Daft.ie began their analysis of the market 10 years ago.