€100,000 cost of raising a child up to college age

The research by Laya Life, based on a survey of 1,000 parents, examines the significant child-related costs parents incur over the first 21 years, from the everyday cost of food and clothing, to the higher costs of childcare and education.

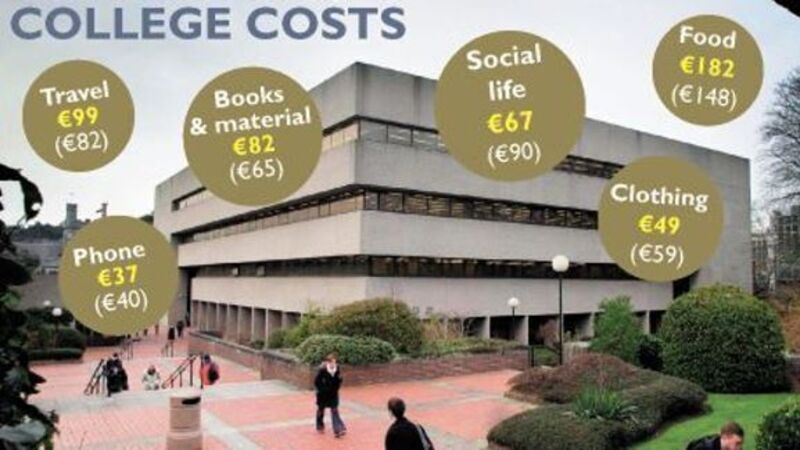

The study found that Irish households are spending an average of €11,033 every year on their children.