Banks’ veto on mortgage deals ‘to be diluted’

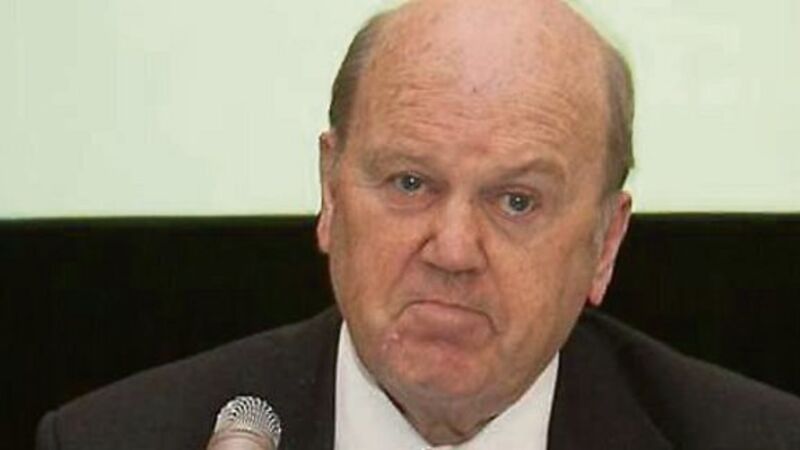

Separately, Mr Noonan will also examine research on mortgage costs next week which he is expected to then use to push bank bosses into reducing their interest rates for borrowers.

The developments comes as the Coalition’s long-awaited measures to help those with unsustainable mortgage arrears is also set to be decided next week.