Major tax boost for high-paid executives coming to work here

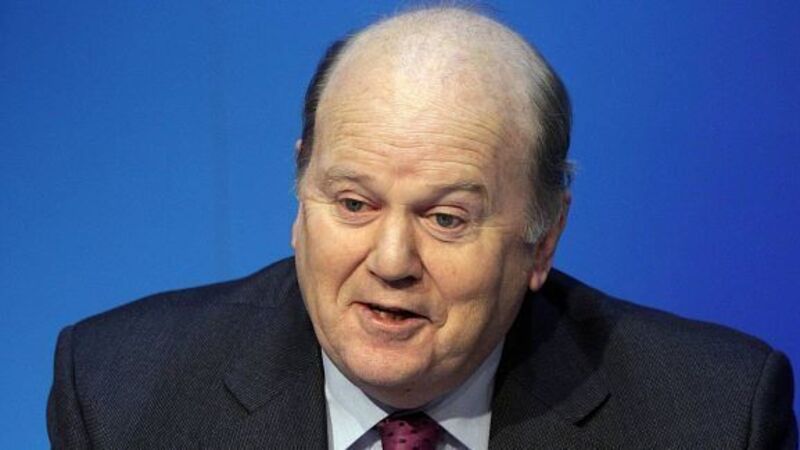

Finance Minister Michael Noonan confirmed the measure yesterday as he published the Finance Bill which gives legal effect to the budget for next year.

An overhaul of the Special Assignee Relief Programme will see a cap lifted on the amount a senior executive earns where 30% of their income is exempt from income tax.