Nama may reverse ban on loan buy-backs

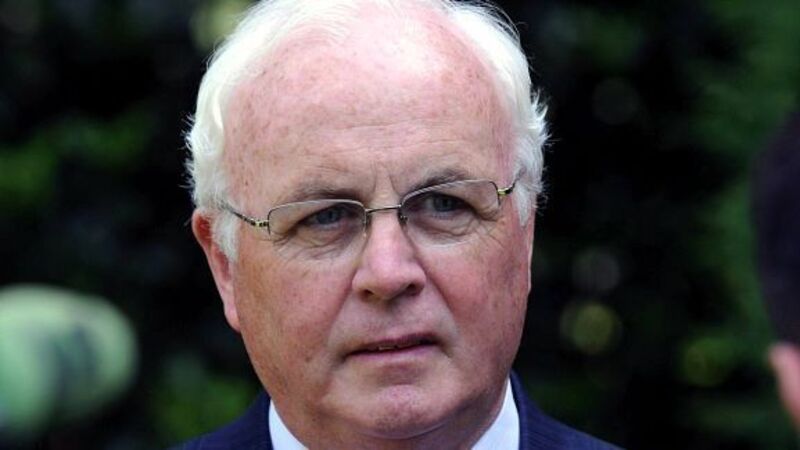

Yesterday, Nama chairman Frank Daly said if they were left with a “rump of assets that nobody is interested in except perhaps the actual debtor”, then the possibility may be considered down the line.

Currently, defaulting debtors in Nama are prohibited under legislation from buying back their own loans, unlike debtors of the Irish Bank Resolution Corporation.