Artificial intelligence boom spreads beyond chipmaker Nvidia

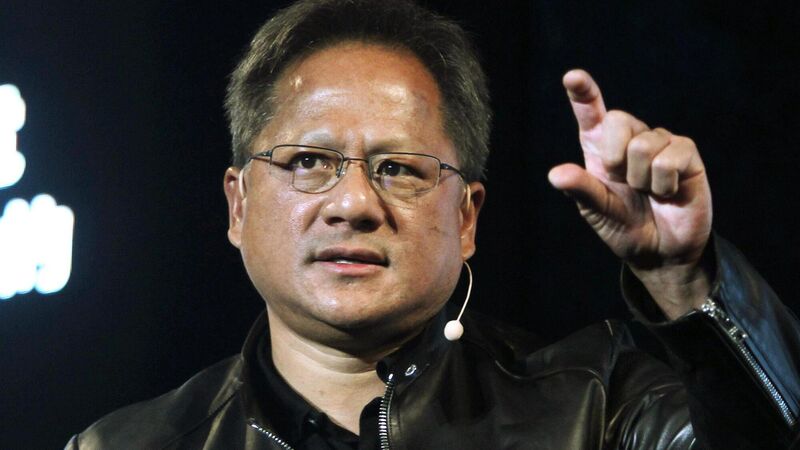

Nvidia chief executive Jensen Huang. The gains on the Philadelphia Semiconductor Index underscore a trend that’s been brewing in the AI space, as investors seek out stocks that can possibly replicate the eyepopping returns of Nvidia — which remains the only game in town when it comes to the market for processors that power AI workloads.

They may lack the pure-play allure of Nvidia, but hardware firms that provide the infrastructure for artificial intelligence computing are becoming the next hot trade.

While the likes of Micron Technology, Super Micro Computer, and Dell Technologies have been rewarded for proven results, expectations are building ahead of the next earnings season. Nearly half the stocks on the Philadelphia Semiconductor Index have jumped at least 10% already this year, pushing the gauge’s price-to-sales ratio to its highest level in at least two decades.