Irish manufacturing sharply down in April as foreign orders slacken

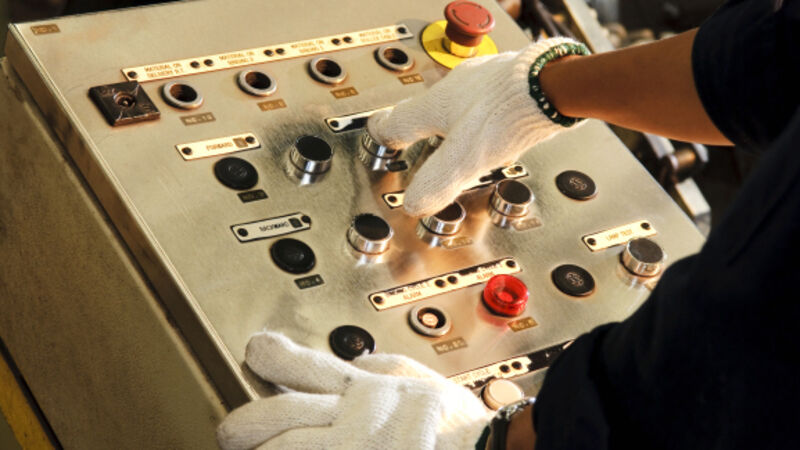

Irish factories reported that the prices they paid for raw materials eased in April, the first monthly fall since the early summer of three years ago. File picture.

Output from Irish manufacturing contracted sharply last month as weakening foreign orders amid a slowdown in European and US economies weighed on the many export-led multinationals located here, the latest survey of purchasing managers here suggests.

The AIB Purchasing Managers' Index had better news, however, on the prospects for inflation, as Irish factories reported that the prices they paid for raw materials eased in April, the first monthly fall since the early summer of three years ago, while they increased their product prices by the lowest rate in 28 months.

The AIB Irish factory survey is just one of a series of monthly surveys of purchasing managers that S&P Global carries out in almost every country across the world. The Irish survey is closely watched for the many pharma and medical equipment firms based in Ireland selling into global markets in the hope that the results can provide a useful barometer of the health of the world economy.

At 48.6, the headline result in April's survey was down from 49.7 in February, marking the second successive monthly fall in output, where any level below 50 suggests that Irish manufacturing output has contracted in the month.

Nonetheless, employment levels in manufacturing here were up for the fifth month in a row, which may suggest any fallout from weaker foreign orders may be limited for the domestic economy.

"Irish manufacturing remained weighed down in April by ongoing weakness in orders and production, reflecting subdued demand conditions, including in overseas markets," said AIB chief economist Oliver Mangan, in a commentary on the survey.

The factory survey does not include a breakdown between exporting manufacturers dominated by the US-owned multinationals and Irish-owned manufacturers such as food firms that rely on the domestic economy for their sales.

A separate survey, also published on Tuesday, however, suggests that small Irish food manufacturers are weathering the inflation crisis.

The SME Food Barometer by PwC and lobby group Love Irish Food suggests almost all of the food firms surveyed are confident about the outlook, despite many facing difficulties in recruiting staff.

Rising costs of raw materials was still the biggest threat cited, but food firms also see staff shortages as a key threat.

“Irish food and drink companies are upbeat about the future and are confident about their organisations’ abilities to innovate and tackle the challenges ahead," said Owen McFeely, director at the PwC Retail and Consumer Practice.

Love Irish Food executive director Kieran Rumley said: "While Irish food producers are facing major challenges with inflation, supply chain issues, labour retention, and energy costs, there has been a noticeable improvement since last year and it is promising to see the confidence and resilience these businesses are demonstrating in their growth prospects."