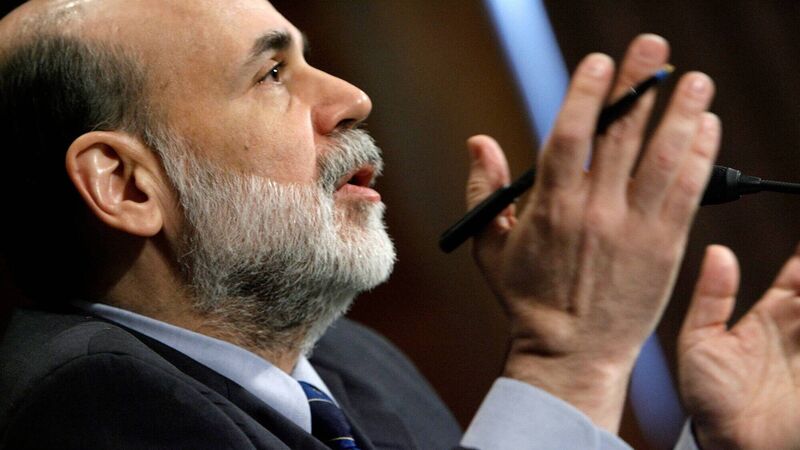

Ben Bernanke shares Nobel Economics Prize for research into crisis-era banks

Former US Federal Reserve chair Ben Bernanke argued at the time that there was no legal way to save Lehman so the next best thing was to let it fail and use the government's financial resources to prevent wider systemic failures.

A trio of US economists, including former Federal Reserve chair Ben Bernanke, have won this year's Nobel Economics Prize for laying the foundation of how world powers now tackle global crises like the recent pandemic or the Great Recession of 2008.

The trio, who also include Douglas Diamond and Philip Dybvig, won for their research on how regulating banks and propping up failing lenders with public cash can stave off an even deeper economic crisis, such as the Great Depression of the 1930s.