Russia set to earn €295bn from gas and oil global exports this year despite sanctions

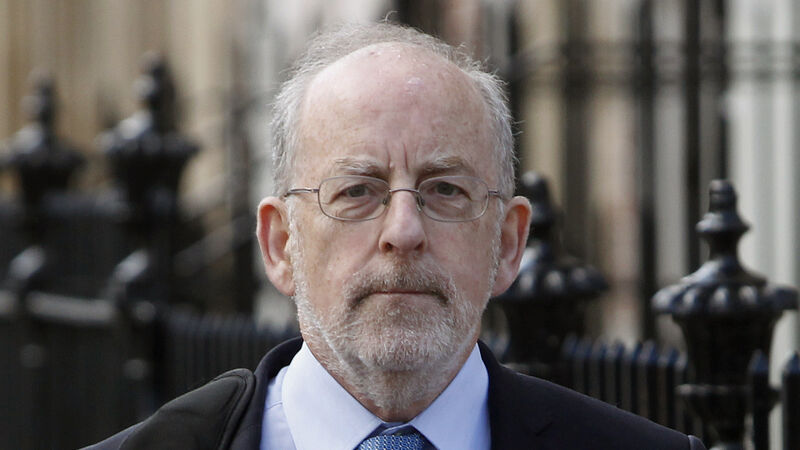

Former Central Bank governor Patrick Honohoan: Sanctions fall short of crippling the Russian economy, as long as they do not interrupt the flow of revenue from exports.

As Europe prepares to join the US in hitting the Kremlin with tighter sanctions for its war on Ukraine, there are plenty of signs that Russia is finding ways to prop up its economy.

Cargoes of Russian crude oil have sold out for next month, and several Chinese firms used local currency to buy Russian coal in March. Gas flows from Russia to Europe have, if anything, increased since the invasion on February 24. None of these are the subject of restrictions.