European wholesale gas prices surge 10% amid new fears over Russia supply

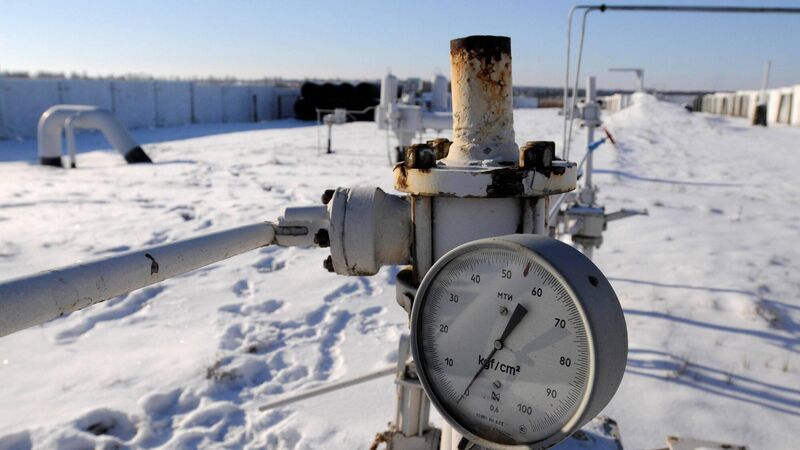

A gas pressure gauge of a main gas pipeline from Russia in the village of Boyarka near the capital Kiev, Ukraine. Picture: Sergei Chuzavkov/AP

European wholesale gas prices surged on signs that Russia will not deliver the boost in supplies president Vladimir Putin promised — at least not today.

Contracts traded in the Netherlands — a benchmark for the whole of Europe — surged almost 10% on Monday as gas orders via a key Russian pipeline signalled that shipments will remain well below normal.