Flutter shares fall 4% despite a jump in revenue

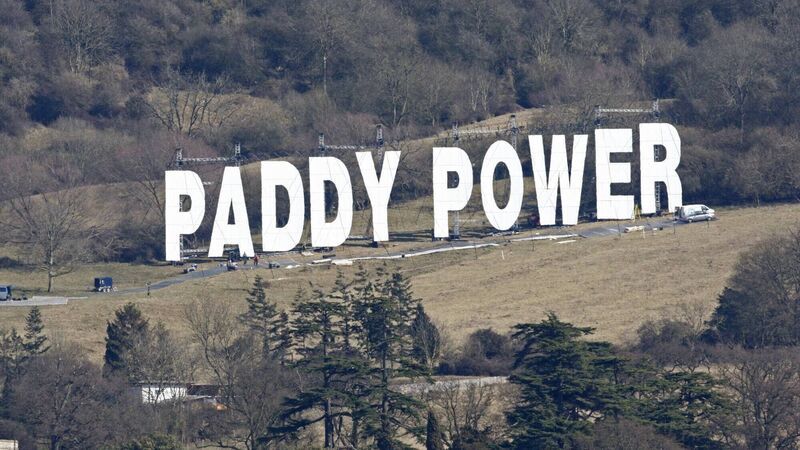

Flutter owns Paddy Power in addition to other betting brands. Picture: Action Images / Paul Harding

Paddy Power owner Flutter shares tumbled around 4% despite reporting a jump in revenue during the first half of the year, driven by its FanDuel brand turning a profit in the US.

In a trading update, the betting giant posted core earnings of its net debt increased to £4.6bn, up 54% on the same period a year earlier, and revenue declined by 1% in Australia due to a changing tax environment.