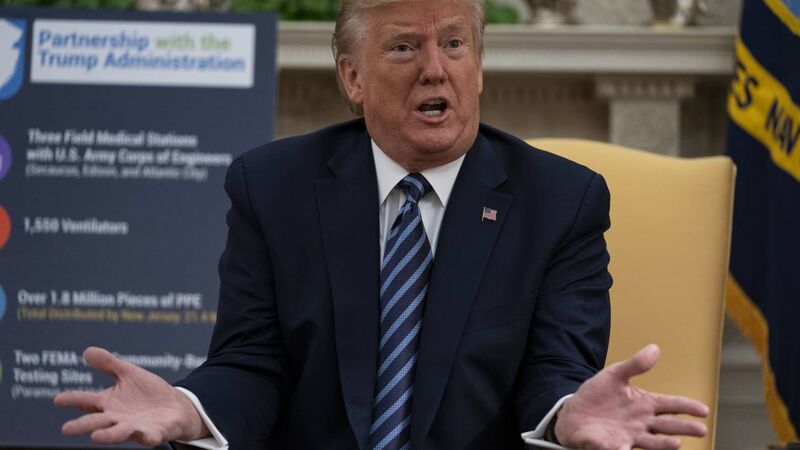

Dettol maker reports record sales after warning against Trump Covid comments

Harpic and Dettol maker Reckitt Benckiser is emerging as one of the biggest corporate winners from the Covid-19 crisis, as it achieved record sales growth in the first quarter and predicted a stronger-than-expected performance in 2020 as customers stocked up on disinfectants.

The boom in demand has come as the company had been battling intense competition in the health and hygiene industry.