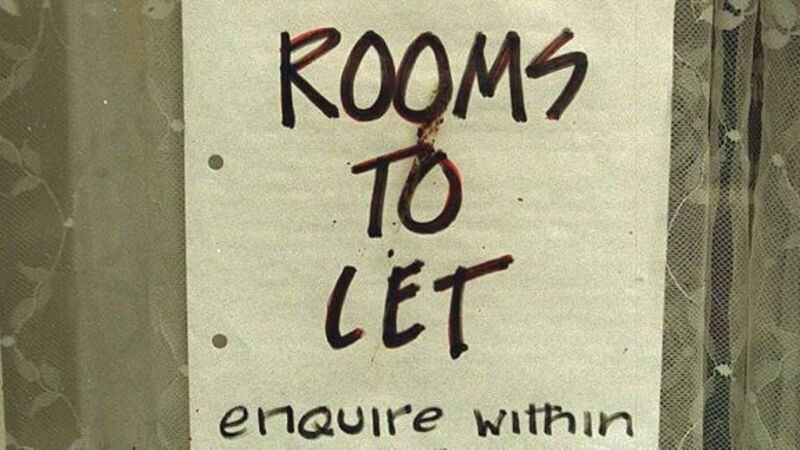

Inflation eases as motor insurance and rents soar

The CSO said that its consumer price index showed that prices across the economy rose only slightly last month and had fallen in the year to June. The CPI rose 0.3% in June, but fell 0.1% from a year earlier.

However, the figures showed the declines in the overall index mask sharp rises in car insurance —up almost 16% in the past year.