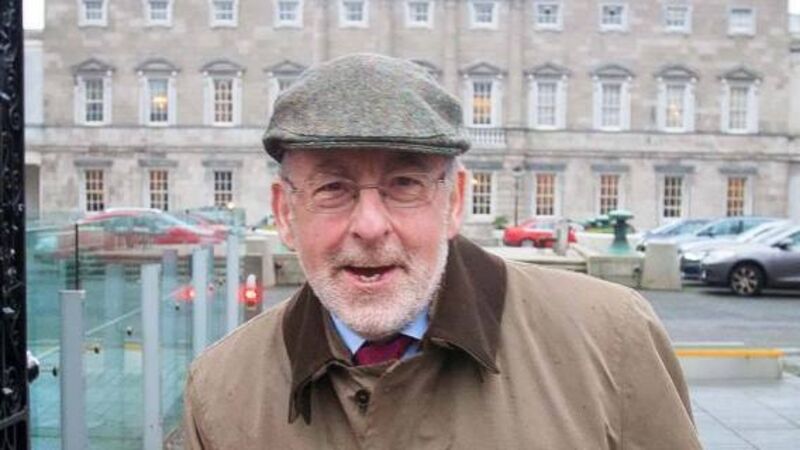

Patrick Honohan: Strengthen laws to tackle bad bankers

In a speech to the annual conference of the George Soros-chaired think-tank, the Institute for New Economic Thinking (INET), in Paris yesterday, Mr Honohan said that while the behaviour of bankers in the run-up to the financial crisis in Ireland was more “unwise” than criminal, it was still the “unrestrained and reckless” behaviour of the Irish banks that de-stabilised the economy and the public finances, here, and not the State’s membership of the single currency.

“The Irish legislative framework deserves to be strengthened to take account of egregious recklessness in risk-taking by those who were in charge of failed financial firms. Recently, the UK enacted legislation of this type, which I believe could be usefully mirrored in Ireland,” he said.