Future of Ireland's biopharma is AI

All the indicators globally are that the biopharma industry is moving toward a tech-driven future of AI-powered drug-discovery research, as the industry grapples to offset the losses from an upcoming €300bn patent cliff.

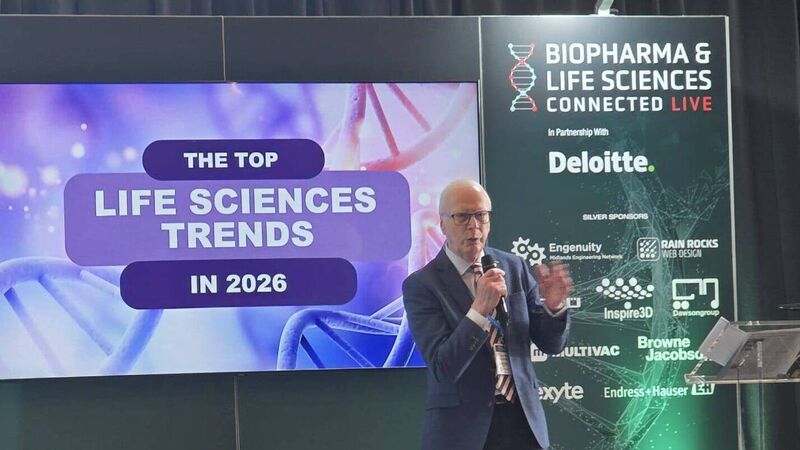

After a year of volatility, the bio-pharma/life sciences sector in Ireland met up in Cork last week with a renewed sense of possibility. US president Donald Trump's shenanigans in Davos fortunately concluded without doing damage.

But Vikram Kunnath, partner at Deloitte, in his keynote delivery to the Cork conference, said that the competitiveness of Irish biopharma manufacturing was dependent on leveraging digitisation and AI.