Investor buys Long Island mansion for record $147m

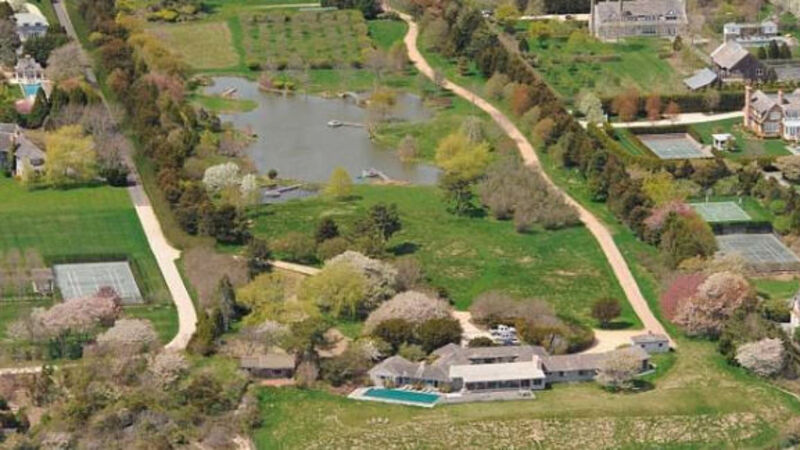

Hedge fund manager of Jana Partners, Barry Rosenstein, has purchased the exclusive 18-acre beachfront property on Further Lane in East Hampton.

The property was sold privately to help the owner avoid paying commission to a broker.