Want some Double Tax Relief?

Double Tax Relief: By contributing €15,000 to your pension, you reduce what you hand over to the Revenue from €40,000 to €28,000 and retain €15,000 for your own future.

Self-employed professionals can avail of a very efficient Double Tax Relief to boost their retirement income, advises , Senior Consultant with Insight Private Clients Ltd

For many self-employed professionals, retirement planning has traditionally been a personal responsibility, one that can easily be deferred amid the demands of running a business.

Unlike employees, who will soon have the benefit of automatic pension enrolment from January 2026, self-employed individuals must continue to take the initiative in building their own long-term financial independence.

The good news is that the Irish tax system rewards proactive planning. Through double tax relief, self-employed individuals can significantly reduce both their final tax for the previous year and their preliminary tax for the year ahead, simply by making a timely pension contribution. It’s one of the most effective and tax-efficient ways to turn today’s profits into tomorrow’s financial independence.

Self-employed individuals pay final tax for the previous year and preliminary tax for the current year. Final tax is due by 31st October (or 19th November if returns are made online), while preliminary tax is an estimate based on your current-year earnings.

If you make a pension contribution before 31st October, you can claim tax relief on it against your previous year’s income, reducing your final tax bill. Because preliminary tax for the following year is generally based on the previous year’s final tax, the same contribution automatically reduces preliminary tax. This is why it is referred to as double tax relief.

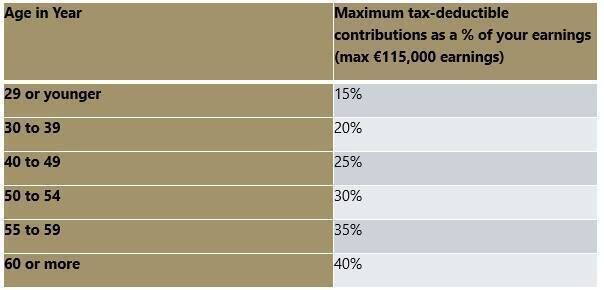

Revenue Commissioners set age-related limits for pension contributions eligible for tax relief:

Consider a self-employed individual under 50 (over 40):

- Taxable profit for 2024: €60,000

- Total tax bill (Income Tax + PRSI + USC): approximately €20,000

Determine contribution limits

- Individuals under 50 may contribute 25% of net relevant earnings to a pension:

- €60,000 × 25% = €15,000 maximum contribution

Tax relief on contributions

- Pension contributions receive relief at the individual’s marginal tax rate.

- Assuming a marginal rate of 40%:

- €15,000 × 40% = €6,000 tax relief

- Net cost to the individual: €15,000 – €6,000 = €9,000

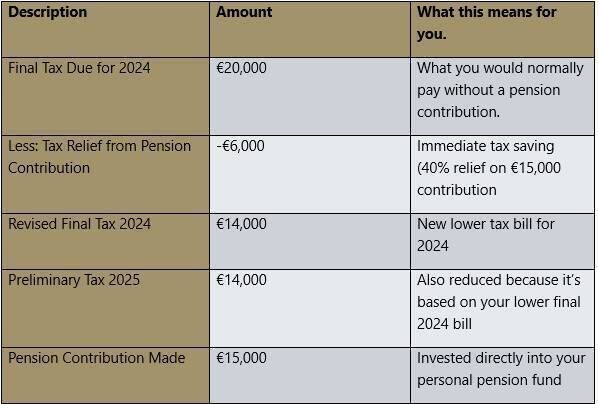

How Your Pension Contribution Impacts Your Tax Bill:

One pension contribution , while building retirement savings.

In this example, without a pension contribution, your combined tax liability for 2024 and 2025 would total €40,000. This is based on your final tax for 2024 (€20,000) and your preliminary tax for 2025 (€20,000).

By making a timely pension contribution of €15,000, you immediately benefit from €6,000 in tax relief, which reduces both your 2024 final tax and your 2025 preliminary tax. Your revised combined tax bill is now €28,000, a €12,000 saving over two years.

In addition to the tax savings, the full €15,000 contribution is invested directly into your pension, allowing you to keep it working for your retirement rather than paying it in taxes. Effectively, you reduce your immediate tax outlay while simultaneously securing long-term financial growth.

Put simply: by contributing €15,000 to your pension, you reduce what you hand over to the Revenue from €40,000 to €28,000 and retain €15,000 for your own future. This strategy demonstrates how proactive planning can both cut your tax bill and build your retirement fund, turning today’s profits into tomorrow’s financial security.

Consistent contributions, even at a meaningful level, can grow into a substantial retirement fund over time. For instance, contributing €15,000 annually from age 45 to 65, with an assumed average annual growth rate of 3%, could result in a pension fund of approximately €403,000 before charges or taxes.

Allowing for typical pension fund management charges of around 1% per annum, the effective return might reduce to about 2%, producing a fund value closer to €366,000.

This example highlights how a structured and disciplined savings approach can build significant long-term value, particularly when combined with the immediate benefit of tax relief on pension contributions.

- Contributions must be made before 31 October to maximise relief for both final and preliminary taxes.

- Documentation, such as a pension contribution certificate, is essential to support your tax claim.

- Professional advice ensures contributions are aligned with your retirement goals, risk profile, and tax planning strategy.

Many self-employed individuals delay pension planning, thinking retirement is far off. However, starting early provides three advantages:

- Contributions benefit from compounded growth over decades.

- Maximise relief for both final and preliminary taxes.

- Structured planning reduces uncertainty and ensures a comfortable retirement.

For self-employed professionals pension planning is a strategic tool for both retirement and tax efficiency. By making contributions before 31 October, you reduce both your and , while securing a meaningful retirement fund.