Budget '26: Ireland kickstarts EU tax alignment for savers

The Irish Government’s strategy must ultimately pivot away from a complex, high-tax, product-dependent system toward one that is simplified.

The Irish government is taking the critical first step in bringing the tax treatment of investment funds into line with Europe.

The Finance Bill 2026, published on October 16th last, confirms the Budget Day announcement of a reduction in the tax rate that applies to Irish and equivalent offshore investment funds, as well as domestic and foreign life assurance products, from 41% to 38%. This change is set to take effect from January 1, 2026.

The Irish Government's commitment to publishing a strategy early next year (2026) to simplify its tax framework is a direct response to the major misalignment between the Irish domestic system and the EU Savings and Investments Union (SIU).

The SIU aims to shift underperforming assets, currently paying meagre returns, into productive capital market investments by mobilising private capital that is currently held inefficiently. This will entail Member States removing tax and regulatory 'frictions.'

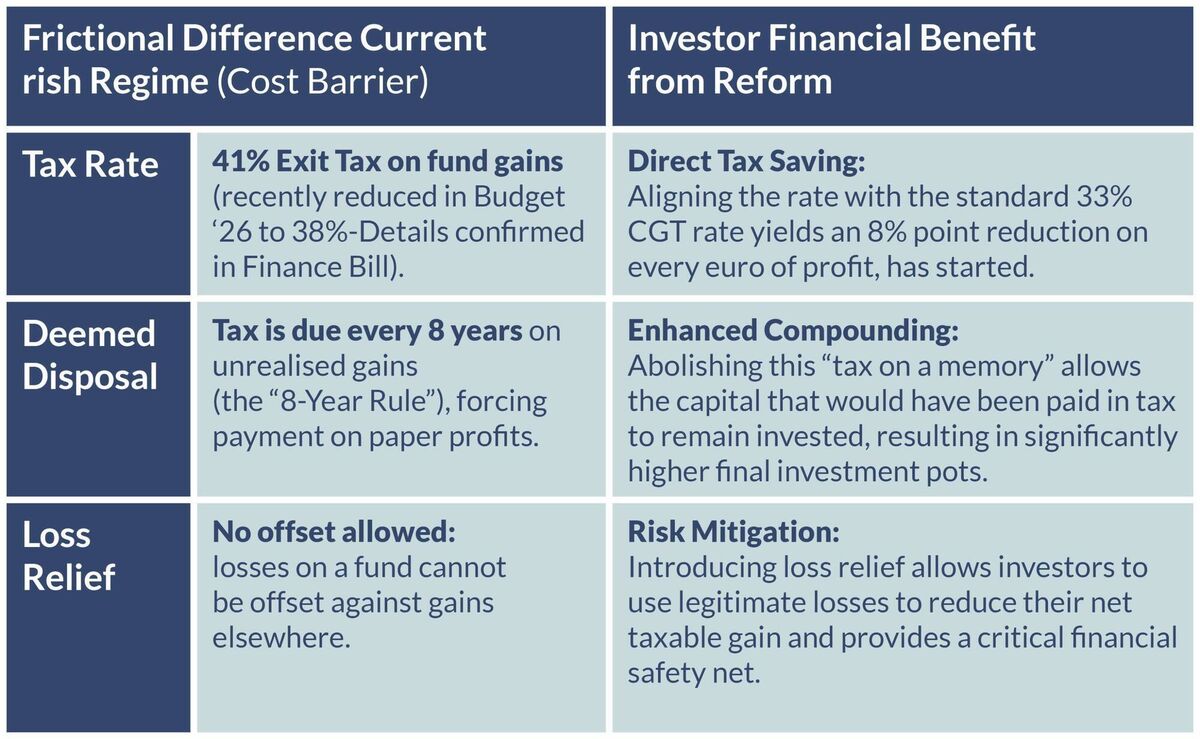

Ireland's current structure creates complexity, discourages risk-taking, and imposes high costs, but the promised reforms will deliver significant and measurable financial benefits to individual and corporate investors through lower tax rates, enhanced compounding, and reduced administrative burdens.

So, what are the current differentials?

The single largest barrier is the punitive and product-dependent tax treatment of investment funds, which is the opposite of the SIU’s goal of simplification and product neutrality.

Irish-domiciled funds and life assurance policies are taxed under the Exit Tax (IUT) regime, which is fundamentally different from the CGT system applied to direct share or property sales, creating a severe cost drag:

This asymmetry means the €1,270 Annual CGT Exemption is unavailable for fund investors, further curtailing potential tax-free returns.

The investor's effective tax rate depends entirely on the wrapper chosen:

- Bank Deposits are subject to 33% Deposit Interest Retention Tax (DIRT).

- Direct Shares are subject to 33% CGT on disposal.

- Investment Funds/Life Policies are subject to the 41% Exit Tax (awaiting Finance Bill details on reduction to 38% timeframe).

Dealing with all the various tax methods adds unnecessary administrative costs and time for investors. This is what the SIU is focused on fixing.

Policy alignment offers direct savings by introducing incentives common elsewhere in the EU.

Ireland currently offers to the highly successful, tax-advantaged savings products used across the EU (e.g., the UK's ISA). The 2026 strategy is ‘expected/hoped’ to explore a European blueprint for a Savings and Investment Account (SIA).

- An SIA would incentivise mass market participation with features like tax deferral until withdrawal, promoting long-term saving.

Policy alignment will directly reduce fees and administrative burdens:

- The eventual abolition of the 1% Stamp Duty on life assurance investment premiums, which acts as a direct upfront frictional cost, will provide an immediate upfront saving for investors choosing this wrapper.

- Streamlining the tax framework will align with the SIU’s goal of automated and simple tax compliance (e.g., through providers handling reporting), reducing the time, complexity, and expense of professional advice currently required to navigate the current mix of tax laws.

- By reducing tax barriers and increasing the flow of domestic capital into the Irish fund market, greater market scale is achieved, which typically leads to lower product management fees charged by providers.

The roadmap must also address broader structural disincentives to the free flow of capital, which is a key tenet of the SIU.

- Ireland's 33% CGT rate is high compared to the 20-25% average in many EU jurisdictions, acting as a direct disincentive for risk capital and entrepreneurial activity. Reducing this rate would stimulate investment.

- The low Capital Acquisitions Tax (CAT) Group A threshold (€400,000) hinders the smooth, inter-generational transfer of family wealth and businesses, restricting capital from entering the more productive investment ecosystem.

- Ireland’s complex Exit Tax regime on non-Irish EU funds creates administrative headaches for cross-border portability and tax-neutral transfers for mobile EU citizens. A seamless tax environment is required for EU-authorised funds, irrespective of domicile.

The Irish Government’s strategy must ultimately pivot away from a complex, high-tax, product-dependent system toward one that is simplified, competitive, and principles-based, delivering both higher net returns and lower costs to the Irish investor. We look forward to the strategy Document in early 2026, with interest.

For more information, visit HERE.