Pension and investment fund inertia: High costs of leaving your pension with a former employer

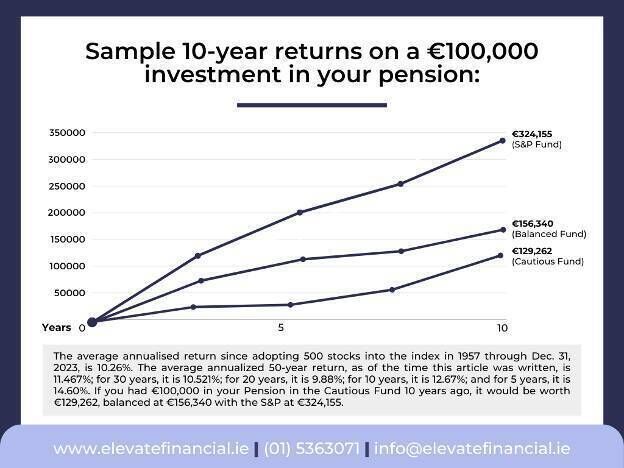

Make smart choices, retire in comfort: Over the last ten years, cautious pension funds have averaged just 2.61% and balanced funds just 4.57% annualised; by contrast, the S&P fund has averaged 12.67% during the same period.

Want to enjoy a comfortable retirement, but not sure what steps to take? of Elevate Financial Planning urges people to talk with a trusted financial advisor

Sage advice from one of the greatest investors of all time, in my opinion. The average annualised return since adopting 500 stocks into the index in 1957 through Dec. 31, 2023, is 10.26%.

The average annualised 50-year return, as of the time this article was written, is 11.467%; for 30 years, it is 10.521%; for 20 years, it is 9.88%; for 10 years, it is 12.67%; and for 5 years, it is 14.60%.

In actuality, the majority of people are unaware of their pension's investment strategy or returns, and billions of euros worth of investor capital is held in funds that perform poorly even during recessionary periods.

I regularly have the privilege of dealing with astute and well-versed clients, and a common observation I make is that they either have no idea how their pension has done or, worse, believe it has done well simply because it is in the green. I get it. This stuff is not entertaining; it's only natural that it's not a priority, but it should be, as it's likely costing you a small fortune, and the only people who find it beneficial are the providers; they depend on your indifference.

At a recent event, we digitally polled the audience and those watching at home while I gave a talk, and most people thought the cautious would be in the range of 1-5%, the balanced between 6-10%, and the S&P at 30%. When it comes to investment, perception and reality diverge more than ever, people are so worried about losing their pots they overestimate the protection and rewards of cautious funds.

In 2022, the assets of Irish pension funds decreased by €157 billion, representing a decline of slightly more than 16% overall. Over the last ten years, the cautious fund has averaged just 2.61% and the balanced 4.57% annualized; by contrast, the S&P has averaged 12.67% during the same period.

Without the calculations for context, it is tough to fully comprehend what that implies for your pension pot.

Here is what it means: if you had €100,000 in your pension in the Cautious Fund ten years ago, it would be worth €129,262, balanced at €156,340 with the S&P at €324,155.

You should talk to someone about the better possibilities that are now available on the market; I'm not advocating that you invest all of your money in the S&P.

For example, several of the most innovative Blackrock, Vanguard, and Fidelity funds you could incorporate into your portfolio with a PRB that are not available with your employer scheme have not only outperformed your funds during the up years but have also outperformed them significantly during the down years.

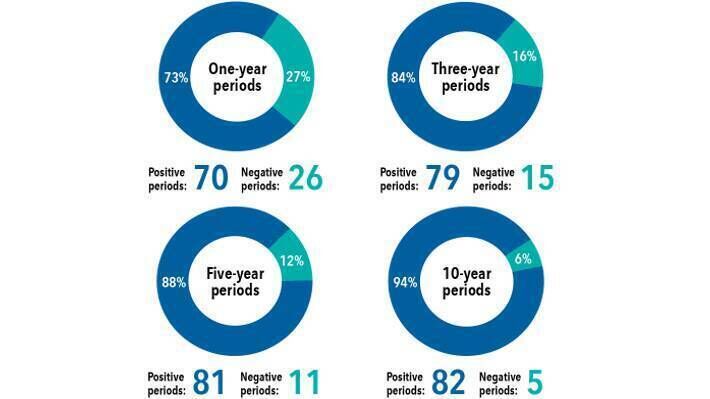

Remember, your investment horizon is the biggest obstacle to increasing your pension pot. The stock market is the opposite of a casino; the longer we have, the better your odds.

Using one of the biggest balanced (risk level 4) and cautious (risk level 3) pension funds in Ireland as an example, the balanced fund saw a 14.57% decline in 2022, while the cautious fund had a 12.41% decline.

In context of this, the S&P (risk level 6) dropped 18.32%. The S&P 500 saw its worst-ever year with 38.49% decline in 2008. The average decline in Irish multi-asset pensions was approximately 35% in 2008.

Assuming you reinvested all dividends, an investor who put €100 into the S&P 500 at the start of 2009 would have around €852.89 at the end of June 2024. This translates to an annual return on investment of 14.92%, or 752.89%.

You would have gotten €549.02 if you had done it at the beginning of 2008, which as previously stated was the worst year ever for the S&P. This translates to an annual return on investment of 10.93%, or 449.02%.

For more background, if you take the time to investigate the multi-asset funds you currently use, you will profit each and every year the S&P rises, and the opposite is also true in years when it falls. A level 5 or 6 multi-asset Irish pension fund will typically have between 65% and 75% of its assets located in North America.

"When America sneezes, the rest of the world catches a cold" springs to mind. Over the past 96 years, the S&P 500 has gone up and down each year. In fact, 27% of those years had negative results. My point, so will your funds and you need to stay the cycle.

I chose to write this article using the S&P because it is the most well-known index worldwide.

However, your pension can now access bond ETFS, NASDAQ, and MSCI for stability and superior mutual funds than the default range that is currently available to you in an employer pension scheme.

The main point I want to make clear is that, while switching to a PRB has benefits like tax advantages, early access starting at age 50, and the ability to combine multiple pensions, among other things, the main reason you should consider one is to make sure your current investments are being made the most of.

I can't emphasise this enough, but in order to ensure that your retirement is as comfortable as possible, locate a trusted advisor and make the effort to get it taken care of.

- Conor O’Shaughnessy, CFP SIA QFA, with Elevate Financial Planning, specialising in pension, investments and portfilio advice. Email: