Auto-enrolment and existing pensions: What you need to know

While pensions auto-enrolment will help boost many people's retirement pot, everyone's retirement plan is personal to them; talking to a pensions expert is a sure way to ensure you have the savings you need to fund the retirement of your dreams.

, CEO of Ask Acorn, outlines the main changes and impacts we can expect with auto-enrolment pensions

Auto-enrolment is due to be launched at the end of September 2025. If you are an employee over age 23 and under age 60, earning over €20,000 a year and are not paying into a private pension such as a PRSA or a company pension plan, you will be auto-enrolled once the system is up and running.

This may benefit you as your employer will also be required to contribute the same amount as you pay to your auto-enrolment account. In addition, the government will add in €100 for every €300 you pay in yourself. This means that for every €300 you pay, a total of €700 will be paid to your pension account including your employer’s contribution.

While this sounds like a great deal, depending on your personal circumstances, particularly your marginal income tax rate, you might be better off saving for your retirement with a private pension arrangement or through your employer’s pension scheme.

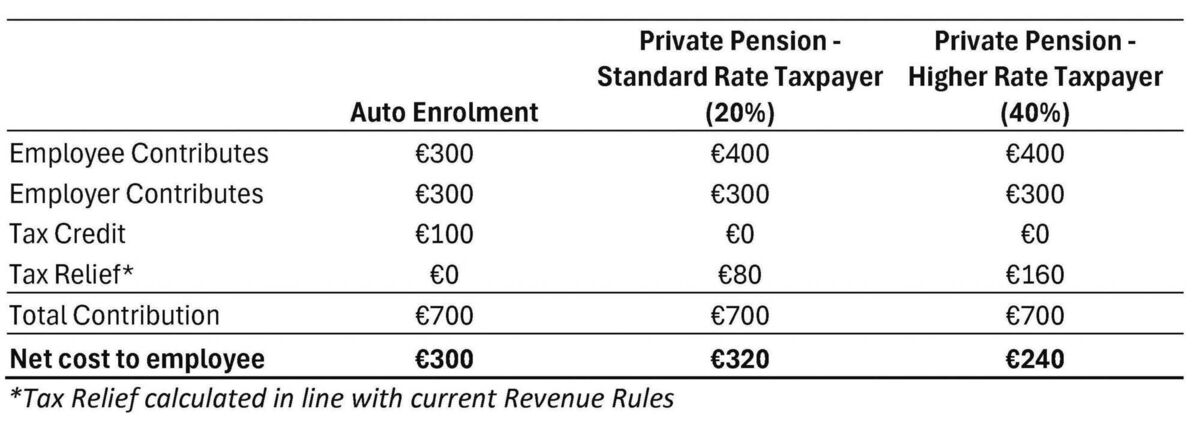

To illustrate this, the accompanying table shows the cost to an individual of a total pension contribution of €700 in each of the systems. In each of the three examples, the employer pays a contribution of €300. The gross employee contribution is adjusted to ensure that the overall total contribution is the same in each scenario.

An employee who is auto-enrolled would have to pay €300 out of their net pay for a total contribution of €700. A higher-rate taxpayer can achieve the same total contribution of €700 to a private pension for a lower net cost after tax relief of €240.

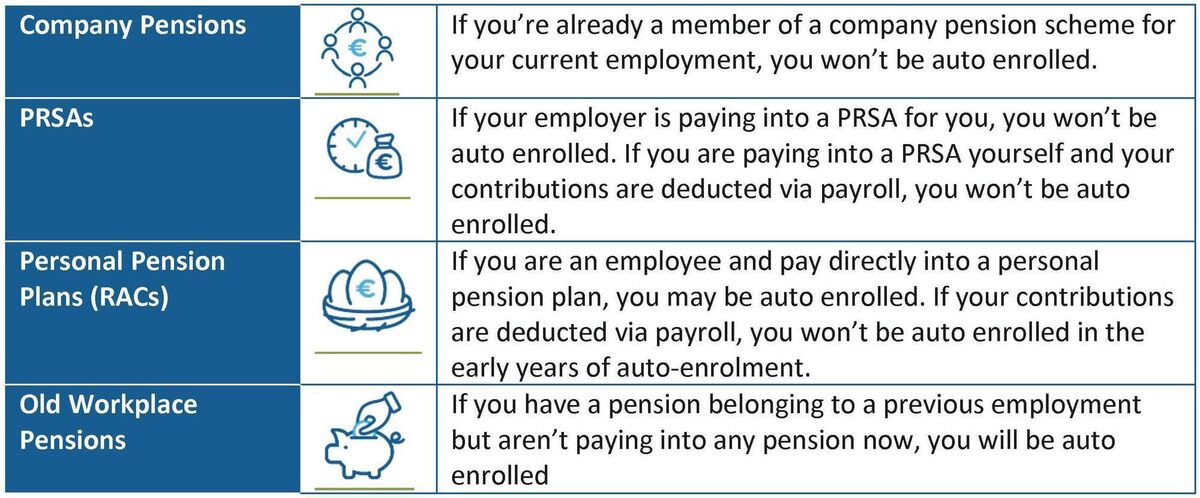

If you are already saving for your retirement through a private pension or your employer’s existing pension scheme, you might be automatically excluded from the auto-enrolment scheme. It’s not entirely straightforward however as it depends on the type of pension plan you have and how you are paying contributions to it.

Put another way, if you are paying contributions to any private pension via payroll or are a member of your employer’s company pension scheme, you won’t be auto-enrolled in 2025.

The auto-enrolment system only applies to employees. If you are self-employed, you will not be auto enrolled and can continue saving in your existing pension arrangement if you have one.

In the early years of auto-enrolment, any level of contributions via your employer’s payroll to a company or private pension plan will exempt you from being auto-enrolled. This is likely to change by the end of year six at the latest after auto-enrolment becomes operational. By this time, the Pensions Authority, together with NAERSA, the National Automatic Enrolment Retirement Savings Authority, will have developed minimum standards for PRSAs and occupational pension schemes.

It’s not yet known what the standards will specify, however, the minimum standards are likely to mandate minimum contributions in line with what would be paid if the individual was auto-enrolled. Under auto-enrolment, by year four, the employer and employee will each be required to contribute 3% of earnings to the auto-enrolment scheme, increasing to 4.5% each in year seven and 6% each in year ten. The minimum standards may therefore result in an increase to both employer and employee contributions to private pensions.

Multiple Employments If you have more than one employment, it may be possible to continue contributing to your existing private pension plan and get tax relief against income for one employment, while being in auto-enrolment for another employment. This allows you to maximise the benefit from both systems.

It is worth remembering that while contributions through payroll paid to a personal pension plan will exempt you from auto-enrolment initially, this is likely to change following the introduction of minimum standards for PRSAs and occupational pension schemes by the end of year six of auto-enrolment at the very latest.

The minimum standards are likely to mandate a minimum level of contribution both from the employer and employee. If this happens, once the minimum standards are introduced, you may need to ensure that your pension contributions are paid to a PRSA or your employer’s pension scheme rather than a personal pension plan if you wish to avoid being auto-enrolled.

It is also more tax-beneficial for employer contributions to be paid to a PRSA or company pension scheme than to a personal pension plan. Contributions paid by an employer to a personal pension plan would be subject to USC and PRSI but are exempt from USC and PRSI if paid to a PRSA or company pension scheme.

If you are over age 23 and earn more than €20,000 a year and don’t want to be auto enrolled, you should consider contributing to a PRSA or joining your employer’s company pension scheme.

There are lots of factors to consider, including:

- How much the employer would contribute to a private pension arrangement compared to the auto-enrolment scheme.

- The tax treatment of contributions is also very different in the two regimes — tax relief is given against contributions to private pension arrangements but not for auto-enrolment where a credit is paid to your auto-enrolment account by the government instead of tax relief. If you are a higher-rate taxpayer, the tax relief is greater than the tax credit payable under auto-enrolment, as you can see in the table above.

- A private pension may have a greater range of fund choice for the investment of your pension savings. This is great if you want to have more input into how your funds are invested.

To get ahead of the game before auto-enrolment kicks in automatically, a financial advisor can assist you in understanding what kind of pension you already have and whether it is worth taking action now to ensure that you avail of the pension solution most suited to your needs.