Multimillion euro trophy homes were all the rage in 2023

Cuskinny Estate Cork launched in 2023, guiding at €4m all-in. The house and gardens found a Cork buyer for c €2m, the land selling separately

The country market is very much the quaint cousin of the general property market yet this is absolutely part of its appeal and attraction to prospective purchasers.

Sales brochures have changed little in 30 years and indeed properties may be sold off market without any brochure being prepared. Properties are rarely purchased for short term gain or for a quick turn as their popularity is intertwined with a feeling of stability and tradition coupled with their perception as a good medium to long term investment. In an uncertain world, such physical ‘real’ assets are considered a sound place to tie up a large sum of money and an increasingly sought after non-fungible investment class in our digital world.

Which brings us to this year’s extraordinary sale of The Barne Estate, Clonmel, undoubtedly the highlight of the year for all sorts of reasons including the reported sale price, believed to be at €20 million.

The sale has received saturation coverage for months in the mainstream, property, and gossip pages of the media as a bidding war to secure the property drove the price up from the €13.50 million guide price and culminated in a High Court action.

In the super-prime sector of the market, such competition is becoming less unusual and not only reflects this appeal but also serves to underline the current strength at the top of the market, especially where large tranches of land are involved. The sale of Dripsey Castle, west of Cork, which closed late last year at a figure believed to be close to €6 million – double the guide price – was a further example of competition for such properties.

Also noteworthy is that both properties were bought by Irish nationals.

Such property has invariably many attributes attached including a sought-after rarity value and standing as a trophy property with all the inbuilt prestige and status that come with such a purchase. Also to be expected are maximum privacy with mile-long-drives and, often, estate-walled security as standard affording the highest level of insulation (if required) from the outside world.

There are, most likely, solid income streams in place with further potential to be exploited from agricultural and/or leisure/tourism enterprises, such as festivals, or the rental of land and lodges to help defray running costs. With such big beasts roaming the plains, expect to see further super-prime offerings or deals emerge over the next year or so.

Last year, we posited that 2022 might be remembered as the zenith of the country market for a while but hedged our bets by observing that we live in uncertain times. Now at another year’s ending, 2023 has likewise turned out to be an exceptional year, with plenty of activity and deals made, especially in the coastal market which has gone from strength to strength in recent years. The exceptional demand for and prices commanded such property has continued to surge and has certainly outstripped last year’s performance. This trend which began in Covid times has now expanded out from such traditional hotspots such as Kinsale, Kenmare, Ardmore and West Cork along the province’s coastlines.

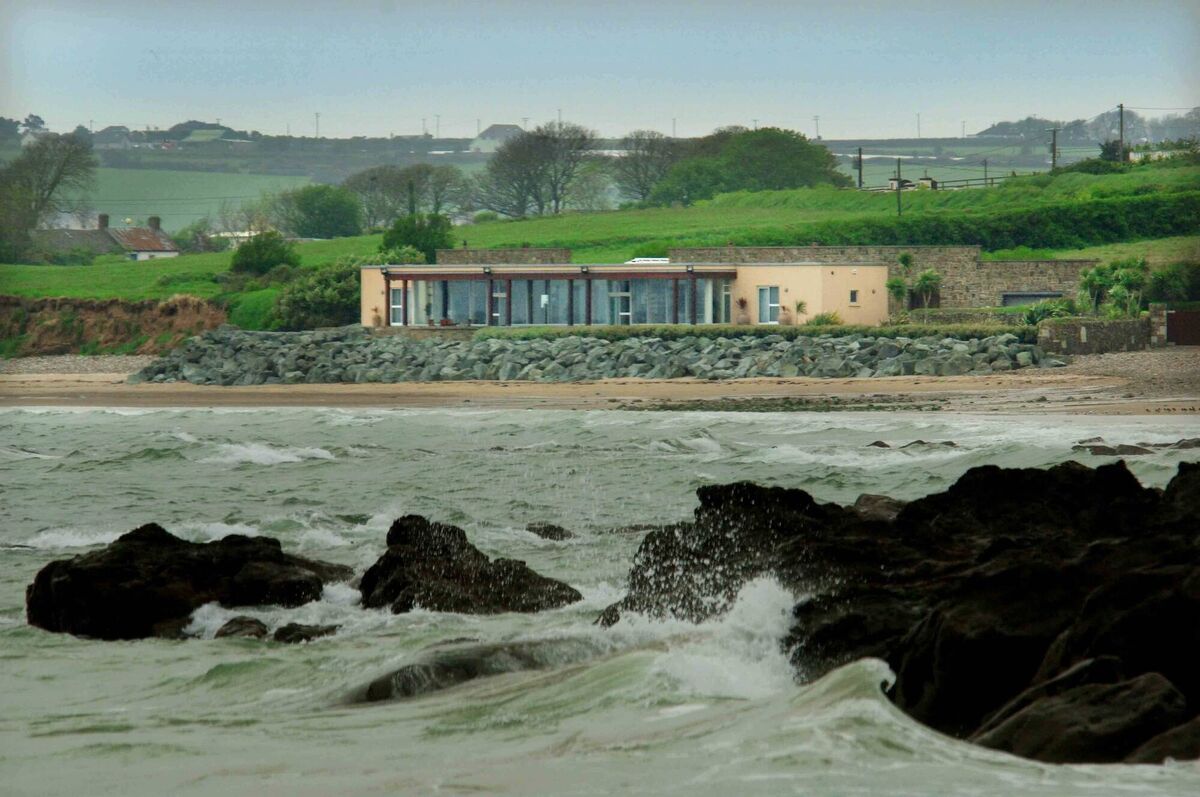

The stunning Horse Island House at Loop Head in Co Clare launched at €9.75 million whilst new entrants in Co Cork included the harbour-front 19th Century Cuskinny Estate, Great Island launched at €4 million guide price and Sprayfield, Kinsale at €4.75 million, with both finding buyers by year’s end.

The coastal activity was replicated with the sale of Annefield, Oysterhaven making close to €3 million, Lugdine Park, Glengarriff fetching over €2.50 million and Leighmoneymore House at Dunderrow fetching over €2.25 million.

In Co Waterford, Pebble Beach, Ardmore appeared in the price register at €3.85 million with The Seafield Estate, Bunmahon selling close to the €1.80 million guide price.

In Kerry, Alpha Lodge and Treanoughtragh both in Dooks made close to €2 million and €1.50 million respectively whilst Long Lake House, Sneem is listed as achieving in excess €1.80 million.

Inland, top honours went to Knocktoran Stud Kilmallock in Co Limerick which fetched €4.3 million at auction with Island House, Castleconnell also in Limerick making over €2 million.

In a busy year for Co Tipperary, another stud property, Rocklow House Stud, Fethard is believed to have made circa €3 million with the nearby Ardsallagh Estate believed to have achieved circa €2.50 million. Slevoir House on Lough Derg is reported to have exceeded the asking price of €2.95 million with Knocklofty House, Clonmel and Killoskehane Castle, Borrisoleigh both making around €1.35 million.

However, there were price drops in Cork for Ballinacurra House, Kinsale to €5.5 million and The Longueville Estate, Mallow to €4.50 million.

Also awaiting buyers were Blackwater Castle, Mallow at €2 million and in Tipperary, Sopwell Estate, Nenagh remains on the market listed at €8.5 million together with with Bellevue, Nenagh at €4.80 million and Killough Castle, Thurles guided at €5.50 million.

In the super-prime sector nationally, there were again very few new offerings to the open market or deals concluded from off-market. Grangecon Stud, Co Kildare was confirmed sold at a believed €10 million plus, whilst as mentioned, The Barne Estate was reported as contracted at figure of circa €20 million.

As we look forward to 2024 it is not hard to envisage a politically tumultuous year ahead. With an election mooted to take place here next year and in the US in November the outlook may become increasingly unsettled. In a recent speech to IPAV annual conference, guest speaker Ivan Yates would have roused any delegates suffering from postprandial lows by saying that “...there is no other sector that will be as negatively impacted by a Sinn Féin government than the property sector’’. Such sentiments have undoubtedly caused unease within the industry.

Likewise, the staging of US presidential elections now heralds huge uncertainty to America and the West with the prospect of a further Trump presidency having wide implications for Europe and the course of the Russian war in Ukraine.

On the positive side of the ledger, the battle to quell inflation looks likely to turn in 2024 with the ECB, Fed and Bank of England all poised to leave interest rates on hold with markets expecting falls next year. Good news also for the country market in the province is the news that the Government is set to invest €12 million in Waterford Airport, with the planned resumption of commercial flights to the UK for the first time since 2016, once the runway extension and upgrade works are completed.

www.michaelhdaniels.com