Ireland's new homes market shows robust nature and beats expectations

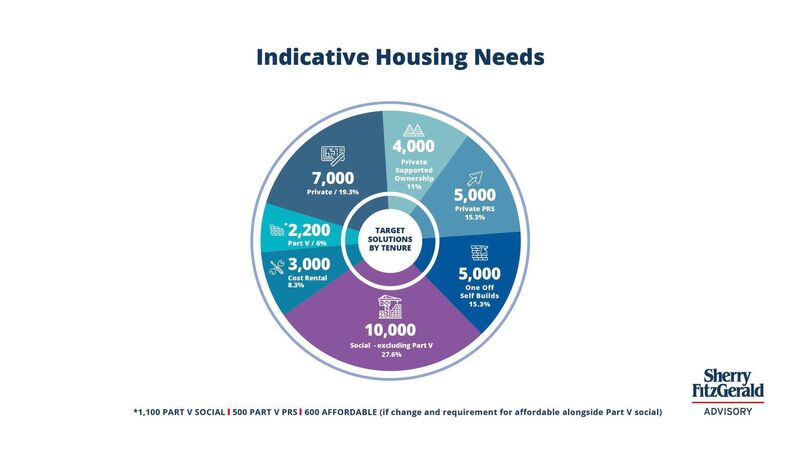

Notional target of national housing needs by type/tenure

2020 was a rollercoaster year with challenges for every industry, but back in March if you had have told me that our annual sales would be 30% higher than last year I would have struggled to believe it.

There has been a very robust rebound in the Cork new homes market over the last number of months.