Data bank will monitor Cork property market for first time

The inclusion of research on performance on the Cork market has been welcomed as a boon to the region by the likes of developer Michael O’Flynn, and by national/international estate agency firms with a Cork presence.

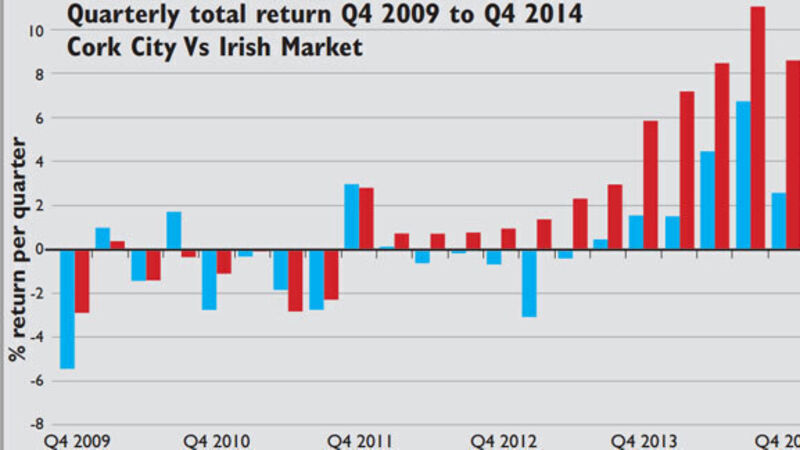

The first authoritative IPD/MSCI research for Cork shows the second city showing ecovery signs at a slight lag to the resurgent Dublin market. The just-released Q4 2014 IPD figures show returns on Irish offices and retail running at twice that of the UK (19.3%), largely driven by increases in office rents.