Irish Examiner View: Soaking the taxpayer has its limits

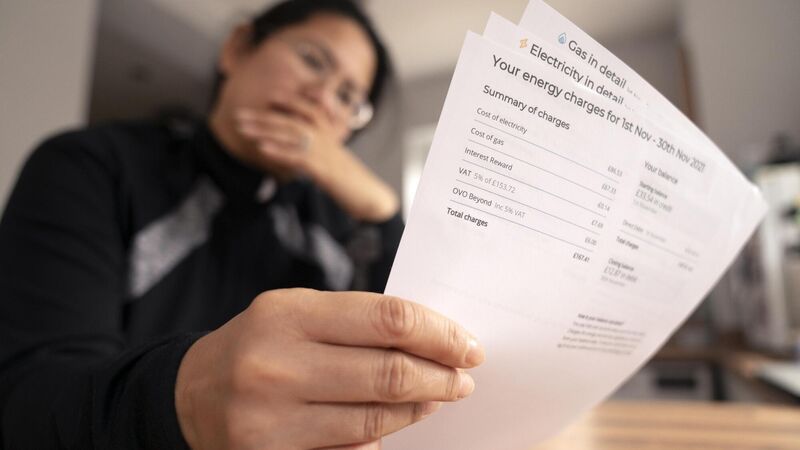

In the UK, there is an increasing clamour for a mass refusal to pay the next swingeing round of energy bill increases in October. File Picture.

It is inevitable in these straitened circumstances that political thinkers are casting around for new ways to separate citizens from their money and add it to the tax pot for them to dispense.

Inevitable, also, that property, in a country which acknowledges that it has a housing crisis and a crisis in finding homes for refugees, should fall under repeated scrutiny.