Middle-class let down by USC plans

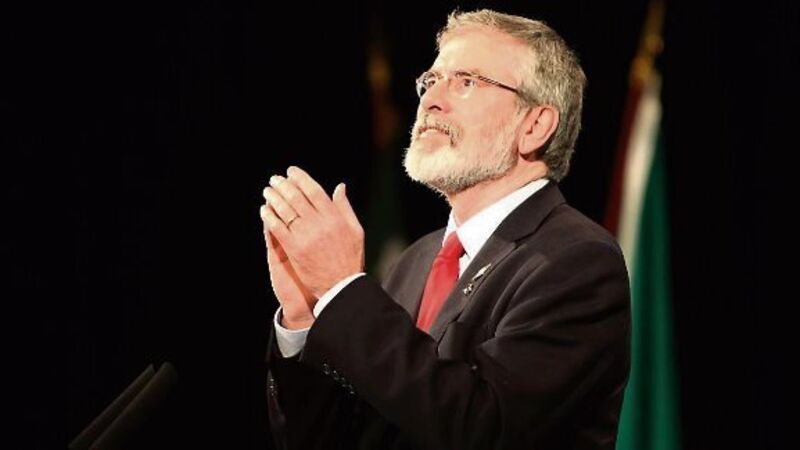

Gerry Adams’ party has thrown in several sweet-eners for voters among pledges in its election manifesto.

However, the election wishlist, while cautious, is evidently funded by keeping crude taxes in place and piling on a few new ones to pay for the promised spending spree.