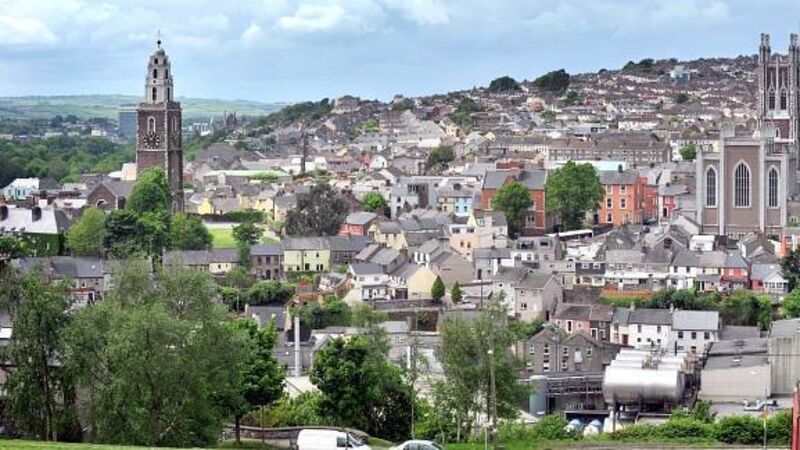

New Beginning for distressed debtors in Cork

It’s probably to be expected.

The advocacy group is one of a number of agencies now working with mortgage holders weighed down with debt, the legacy of the Celtic Tiger and the crash that followed, which has manifestly altered society in ways we are only now appreciating.