Election promises continue the attack on families with one income

ARCHBISHOP Diarmuid Martin called this week for intervention by the mothers and grandmothers of the gangland criminals. He said they were “strong women” and “persons of wisdom”. Who knows if his plea will go anywhere. But at least he recognises the central role a parent can play, not just in a family, but in a society.

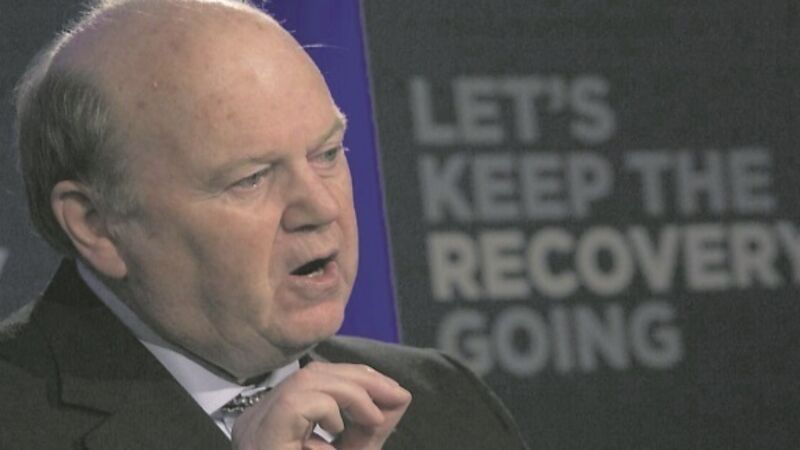

Pity our aim is to put them out of business. This government has continued the work of governments since Charlie McCreevy’s tax individualisation budget in 1999 so that a married couple with two earners can currently bring home over €5,000 more than a married couple with one earner on the same wage.