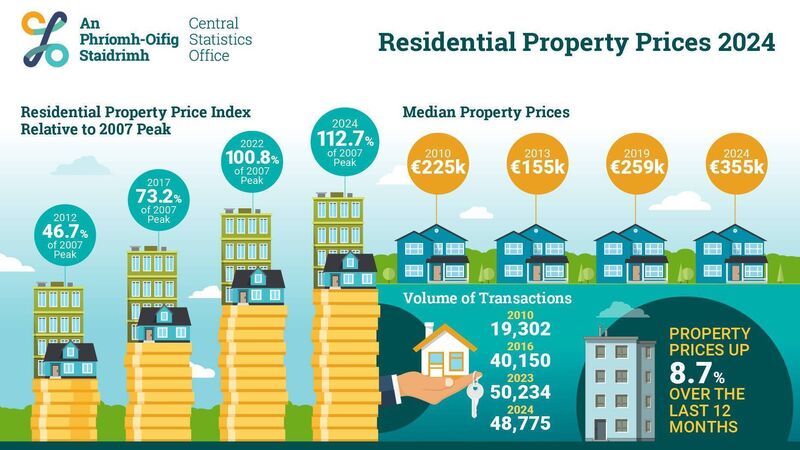

Average house prices soared by over €100,000 in five years, says CSO

The Residential Property Price Index for December 2024 from the Central Statistics Office.

The average price of a home in Ireland surged by more than €100,000 in the last five years, new figures have revealed, as scrutiny falls on the Government over its future housing plans.

According to data from the Central Statistics Office, the average sale price of all homes in Ireland filed with Revenue in December was €420,656 compared to €296,877 in December 2019.