Two years to pay off arrears under new protections from energy price hikes

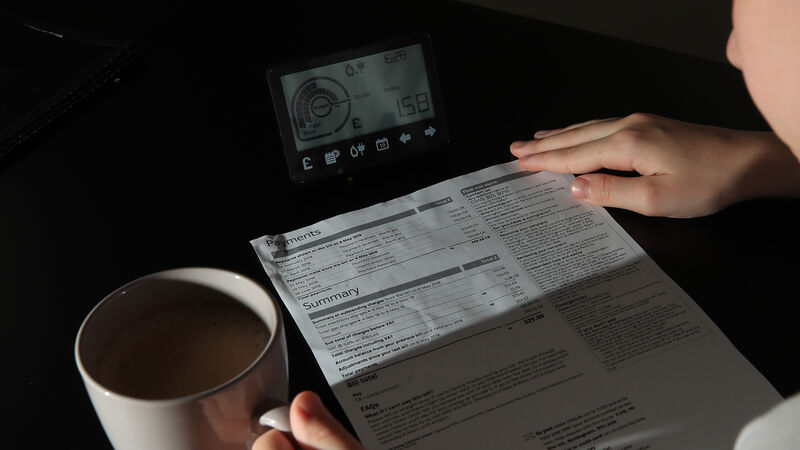

The extension of the moratorium on disconnections and debt repayment plans of at least two years are two new measures announced today by the energy regulator today as part of steps to protect households this winter.

The Commission for Regulation of Utilities (CRU) said the measures come in the context of the current volatility in global energy prices and to “further protect customers facing higher energy prices”.