Nama reports €9.5bn generated from asset disposals and loan repayments

The National Asset Management Agency (Nama) has today stated that the total cash generated from asset disposals and loan repayments now stands at €9.5bn – up from €8bn at the end of June.

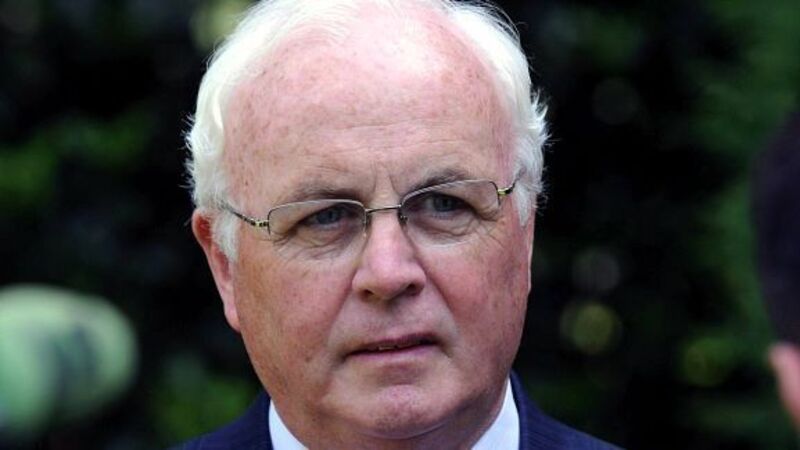

Nama chief executive Brendan McDonagh said the agency’s cash receipts, up to mid-October, include €6.2bn from asset disposals and €3.3bn from recurring income such as rental payments on debtors’ properties and intensive management of assets securing the Agency’s loans.