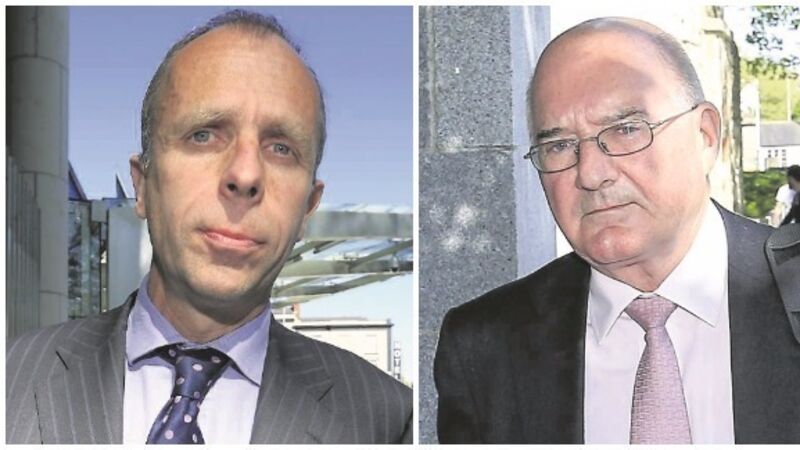

Two Anglo bosses found guilty of plot to defraud public

On day 84 of the longest running criminal trial in the State’s history, the jury at Dublin Circuit Criminal Court returned the majority verdicts. The verdict comes after 38 hours of deliberations, the longest jury deliberations in the State’s history.

The jury is still considering charges against two Irish Life and Permanent bankers who were alleged to have taken part in the €7.2bn conspiracy.