New €4bn fund for SMEs on way

The Government yesterday unveiled its long-awaited state bank initiative, which is supported by German funds as well as other investments from Europe.

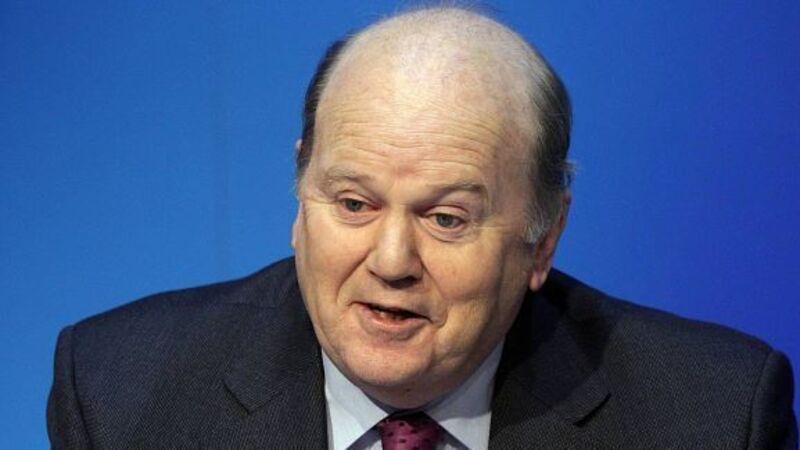

Michael Noonan, the finance minister, said credit was the “lifeblood” for businesses and the new lending arrangements would be in place by the end of the year.