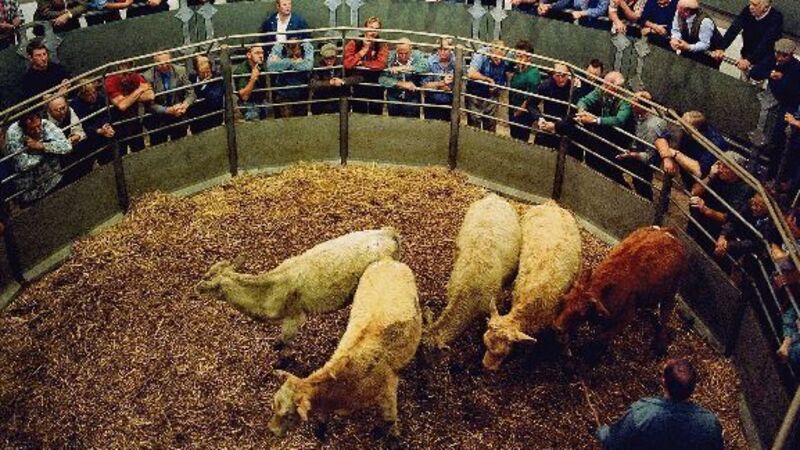

Some marts may go bust following TLT collapse

The overall liabilities to marts and farmers are believed to be in the region of €3m-€4m, while some marts are owed between €300,000 and €400,000 for cattle purchased by TLT.

Up to 30 marts and as many as 25 farmers are owed money by TLT.